This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

October 9, 2019

Charting a Profitable Path to Net Zero Emissions

SR Inc’s 3rd Quarter Symposium Explores How Companies Can Chart a Profitable Path to Net Zero Emissions

As reflected in last week’s blog post the Sustainability Roundtable Inc (SR Inc) hosted its 3rd Quarter Executive Symposium at American Express during Climate Week in New York City. The second half of the meeting examined how leading companies have begun to chart a profitable path to Net Zero Emissions. SR Inc introduced a new Member Briefing and Tools on the subject and Mike Mattera, Director of Corporate Sustainability of Akamai, and Sean Kinghorn, Sr. Sustainability Program Manager of Intuit provided inspiring insight into how their companies were moving to leadership in more sustainable business.

SR Inc COO & Senior Advisor, David Osborn, presented on the key takeaways from the latest SR Inc Member Briefing on Charting a Profitable Path to Net Zero Emissions, which was made available to Member Clients in coordination with the symposium. Many of these developments have occurred in the past few years, so companies should seriously reexamine the possibility of committing to Net Zero Emissions if they have not already. Just during Climate Week alone, we saw the companies American Express, Amazon, Nestle, LG, Duke Energy, and others commit to net zero. Additionally, Net Zero Emissions no longer just refers to scopes 1 and 2, it also includes suppliers and other scope 3 emissions. Key findings from the report and presentation include:

- Net Zero Emissions and 100% renewables have rapidly become a key corporate sustainability strategy, especially among fast-growth companies in the IT and service sectors.

- Key stakeholders increasingly ask for public commitments to long-term value creation strategies and standards setters increasingly require ambitious and Net Zero Emissions reductions goals.

- Companies should score and report emissions and renewable energy strategy internally and externally and should have their C-Suites approve of goal setting and strategy.

- Leading companies first pursue energy efficiency and on-site renewables and then off-site green tariffs, community solar, and direct PPAs, but VPPAs are the most scalable solution, and Buyer Organized Aggregated VPPAs enable smaller commitments that allow more companies to cause new renewable energy and spread risk across multiple transactions and both wind and solar.

- Leading companies, including SR Inc Member-Clients Akamai, Intuit, Cisco, and Bloomberg, are moving away from Unbundled RECs and are embracing Buyer Organized Aggregated VPPAs to chart a profitable path to Net Zero Emissions in a way that causes new renewable energy when smaller direct PPAs might not.

David then shared SR Inc’s step-wise guidance for achieving Net Zero Emissions, broken down into five different components. Member-Clients can find the Member Briefing Working Draft, which includes the full detailed step-wise guidance in the Digital Library. SR Inc also regularly assists Member-Clients one-on-one in developing and achieving strategies for sustainable operations and Net Zero Emissions. The major components of the guidance include:

- Vision and Governance: Commit to sustainable operations

- Strategy: Embrace sustainability for strategic positioning

- Guidance: Select metrics, establish baselines, and develop targets

- Implementation: Drive specific scope 1, 2, and 3 strategies and stakeholder engagement

- Results: Achieve and communicate differentiating strategic integration

Mike Mattera, Director of Corporate Sustainability at Akamai Technologies, Inc. then spoke about his company’s Sustainability initiatives, which are quickly becoming best-in-class. Akamai is exploring ways to make the entire internet and data center sector more sustainable by maximizing server efficiency, ensuring proper disposal of electronic waste, and using renewable energy, especially in its leased-data center locations where most of the company’s impact lies. Akamai is also participating in innovative green power procurement methods like renewable energy passthroughs and Buyer Organized Aggregated VPPAs. Akamai has a 2020 goal to reduce Greenhouse Gas (GHG) emissions below 2015 levels by sourcing renewable energy for 50% of global network operations. The company has a second goal to reduce network energy and scope 2 GHG intensity per unit of traffic per year by 30%.

Mike Mattera, Director of Corporate Sustainability at Akamai Technologies, Inc. then spoke about his company’s Sustainability initiatives, which are quickly becoming best-in-class. Akamai is exploring ways to make the entire internet and data center sector more sustainable by maximizing server efficiency, ensuring proper disposal of electronic waste, and using renewable energy, especially in its leased-data center locations where most of the company’s impact lies. Akamai is also participating in innovative green power procurement methods like renewable energy passthroughs and Buyer Organized Aggregated VPPAs. Akamai has a 2020 goal to reduce Greenhouse Gas (GHG) emissions below 2015 levels by sourcing renewable energy for 50% of global network operations. The company has a second goal to reduce network energy and scope 2 GHG intensity per unit of traffic per year by 30%.

Through partnerships like Renewable Energy Buyers Alliance (REBA), Akamai is working with strategic partners like Iron Mountain to provide data center users with renewable electricity. They are also building strategic partnerships with other renewable energy buyers and developers with a goal to contract renewable energy in their major metropolitan areas. In 2018, Akamai joined Apple, Etsy and Swiss Re for a smaller portion of a 125-MW wind farms in Illinois and a 165-MW solar farm in Virginia through Buyer Organized Aggregated VPPAs.

Mattera finished by giving advice to other SR Inc Member-Clients (see Figure 1) based on what efforts have been most effective in Akamai’s journey: (1) Refine and tailor the value proposition of sustainability with key stakeholders. Mattera meets quarterly with Akamai’s CEO and other C-level executives and is currently partnering with Akamai’s marketing and sales team to better integrate the company’s sustainability investments as a business differentiator. (2) Partner for success! Akamai has been collaborating with organizations like SR Inc, REBA, Business for Social Responsibility (BSR), GreenBiz, and the Future of Internet Power on how to make the internet more sustainable, for all. (3) Find employees that are passionate about sustainability to help promote and integrate your efforts into every facet of the business. Each employee is an Ambassador for your company’s “do good” efforts – educate and engage them on your sustainable work to help spread the word about why and how your company cares about the environment.

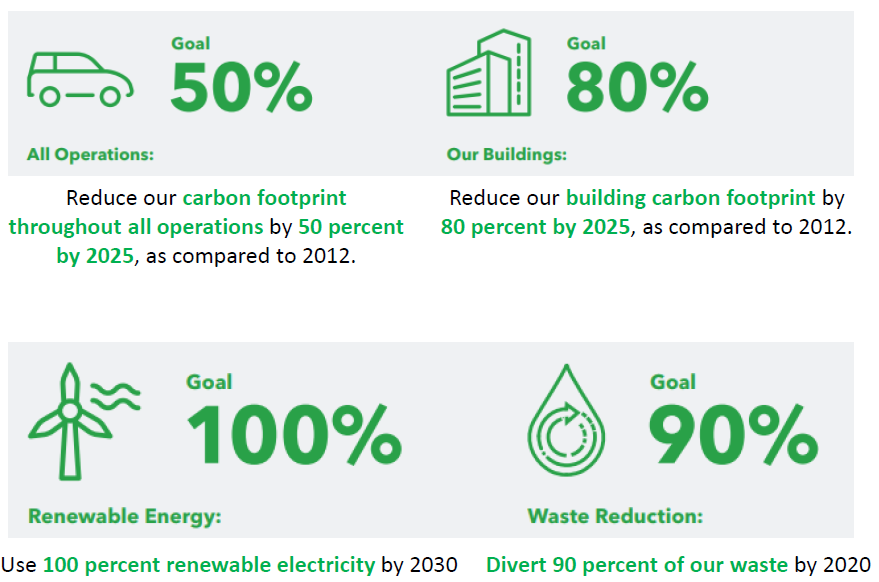

Sean Kinghorn, Senior Sustainability Program Manager at Intuit, then spoke about Intuit’s new bold goal released during Climate Week to reduce carbon emissions 50 times greater than its own 2018 emissions footprint by 2030. Like the response American Express received from its new ambitious goals, Sean was inundated with positive feedback from Intuit employees in the days after the announcement. Intuit’s original 2015 goals were to reduce its operational carbon footprint 50% by 2025, reduce its buildings’ carbon footprint 80% by 2025, and procure 100% renewable energy by 2030 (see Figure 2).

Sean Kinghorn, Senior Sustainability Program Manager at Intuit, then spoke about Intuit’s new bold goal released during Climate Week to reduce carbon emissions 50 times greater than its own 2018 emissions footprint by 2030. Like the response American Express received from its new ambitious goals, Sean was inundated with positive feedback from Intuit employees in the days after the announcement. Intuit’s original 2015 goals were to reduce its operational carbon footprint 50% by 2025, reduce its buildings’ carbon footprint 80% by 2025, and procure 100% renewable energy by 2030 (see Figure 2).

To achieve these goals, the company has developed a three-pronged strategy of boosting energy efficiency internally, investing in renewable energy, and buying carbon offsets:

- To use less energy, the company’s comprehensive energy efficiency program features green building standards and initiatives to address supply chain, business travel, data center, and commuting emissions.

- To invest in renewables, Intuit commits to green tariffs and long-term on- and off-site renewable energy projects, including 10 MW of Texas wind power through a Buyer Organized Aggregated VPPA [what SR Inc’s Renewable Energy Procurement Services (REPS) calls a “VPPA 2.0”] supported by SR Inc REPS. This VPPA is allowing Intuit to hit 100% renewable electricity more than 10 years ahead of its goal.

- To offset the emissions it is unable to eliminate, Intuit has partnered with Project Drawdown to purchase carbon offsets to power prosperity through sustainability projects around the world. Through energy efficiency and renewable energy, Intuit has reduced its reliance on grid electricity by 79% from 2012 to 2018.

In a partnership with Just Energy, Intuit created the highly innovative Purely Green program in 2018 to offer renewable electricity to hundreds of thousands of small business and residential customers across Texas at or below the price of traditional grid power. The RECs are sourced directly from the Lone Star II Wind Farm in Abilene, TX, but they amount to Unbundled RECs since this is existing capacity that was financed through earlier transactions. However, since Purely Green is retailed to employees and other retail customers, this is less material since they often do not need to retire the RECs to meet emissions reduction goals. The program addresses two issues important to Intuit: powering prosperity for customers and being good environmental stewards.

A key piece of advice Sean had for other Member-Clients was, once you get a hold of your direct emissions and environmental impact, look towards your employees, customers, suppliers, and communities for new opportunities. Without innovative programs like Purely Green and without “Earthshot” initiatives like Intuit’s 50x by 2030 goal, we will not meet global emissions reduction targets.

SR Inc is pleased to be actively assisting more than two dozen Member-Clients that can particularly benefit from Akamai’s and Intuit’s advice on using innovative procurement methods and partnerships to achieve Net Zero Emissions for their entire value chains. As we look ahead to our next Executive Symposium in DC December 5th, we continue to invite the input of other Member-Clients and industry leaders to offer their experiences and insights about how to accelerate – and making more profitable – the necessary move to Net Zero Emissions.

As Manager of Research & Consulting at Sustainability Roundtable, Inc., Jeff Meltzer provides outsourced program assistance to clients on a one-to-one basis, helping real estate, operations, and sustainability executives set goals, drive progress, and report the results of their sustainability programs. Jeff holds a Master of Environmental Management from Duke University’s Nicholas School of the Environment and a B.A. in Environmental Policy from Colby College. He has relevant work experience with the Procurement and Property Services team at Citizens Bank as an EDF Climate Corps Fellow, with the EHS and Sustainability team at L’Oréal, and with the EPA Green Power Partnership as an Environmental Analyst at Eastern Research Group. He has client project experience with Biogen, helping the company develop a Scope 3 supplier engagement strategy to achieve its Science-Based Target. Jeff is also an active participant in sustainability groups, is an accredited LEED Green Associate, is trained in the GRI Standards and GHG Protocol, was the Co-President of the Duke’s Net Impact club, and is an active member of the professional Net Impact Boston leadership team.

As Manager of Research & Consulting at Sustainability Roundtable, Inc., Jeff Meltzer provides outsourced program assistance to clients on a one-to-one basis, helping real estate, operations, and sustainability executives set goals, drive progress, and report the results of their sustainability programs. Jeff holds a Master of Environmental Management from Duke University’s Nicholas School of the Environment and a B.A. in Environmental Policy from Colby College. He has relevant work experience with the Procurement and Property Services team at Citizens Bank as an EDF Climate Corps Fellow, with the EHS and Sustainability team at L’Oréal, and with the EPA Green Power Partnership as an Environmental Analyst at Eastern Research Group. He has client project experience with Biogen, helping the company develop a Scope 3 supplier engagement strategy to achieve its Science-Based Target. Jeff is also an active participant in sustainability groups, is an accredited LEED Green Associate, is trained in the GRI Standards and GHG Protocol, was the Co-President of the Duke’s Net Impact club, and is an active member of the professional Net Impact Boston leadership team.