This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

October 24, 2024

Net Zero Consortium for Buyers U.S. VPPA Opportunity Index: 2024 Q3

NZCB Insights from the Field: Change & Growth

One constant in the renewable energy space over the last several years is change. Here’s what we know:

- The upcoming elections in the U.S. will have major impacts on renewable energy incentives, tariffs, and permitting.

- Electricity demand is growing at an unprecedented rate due to data centers, AI, and electrification, which will largely have an upward pressure on realized prices.

- Renewables and storage are growing at a record pace, which will largely have a downward impact on realized prices.

- Weather patterns in the most appealing renewable energy markets have been somewhat stable over the past 12 months, leading to a lack of energy price spikes that we had seen in the prior 36 months.

- Interest rates have finally begun to come down and supply chain pressures have eased, which will largely have a downward pressure on VPPA prices.

Time will tell as to whether these evolving factors will benefit corporate buyers, but we are confident both corporate demand for renewables and the penetration of clean energy and storage will continue its impressive growth. SR Inc looks forward to continuing to advise our growing member base on renewable energy strategies that make the most sense for them amidst this change and growth.

The NZCB General Quarterly Update

SR Inc had the privilege of guiding and representing more than a dozen Member-Clients in aggregated VPPAs through the Net Zero Consortium for Buyers (NZCB) in Q3 2024. We were pleased to announce another successful peer buyer organized aggregated VPPA in Q3 for the 135 MW Prairie Solar project being developed by BayWa r.e. Americas in the carbon-intensive Champaign County, Illinois. With the announcement of this project, the NZCB has nearly achieved its goal of causing a gigawatt of new renewable energy capacity before 2025. Reaching the NZCB’s gigawatt goal will generate enough energy to meet the annual average electricity needs of more than 200,000 U.S. homes while helping mitigate commercial Scope 2 emissions across the business operations of corporate buyers.

Most SR Inc Member-Clients, like most global companies, have geographically dispersed electric loads and are therefore keenly interested in the impact and scalability of VPPAs. This is particularly true in the U.S. / Canada and the AIB countries in Europe, where GHG accounting rules allow them to source renewables and apply the associated energy attribute certificates to any sites within the respective boundaries. However, even when most SR Inc Member-Clients aggregate their load across the U.S. / Canada or the AIB countries in Europe, they still lack sufficient scale to command the most corporate buyer-favorable transaction structuring, ESG impact terms, and pricing when contracting through VPPAs.

Fortunately, SR Inc Member-Clients are able to come together with the assistance of SR Inc’s NZCB to create economies of scale, experience, and intellect. The NZCB’s auditable corporate procurement process and Reverse Auctions have become core to a growing number of SR Inc Member-Clients’ decarbonization strategies. SR Inc Member-Clients have made the NZCB the leading platform for corporate buyer aggregated procurement of utility-scale renewable energy as they help democratize their environmental and financial benefits, previously reserved only for the world’s largest energy users with geographically concentrated demand.

Overall conditions in the U.S. VPPA market have eased for corporate buyers in the last few quarters compared to much of 2022 and 2023, but the upcoming elections bring much uncertainty to the industry. SR Inc’s aggregated procurements have returned to securing mature projects with full hub settlement, zero price floors, firm pricing, and shorter terms despite the fact that developers are continuing to face interconnection backlogs, tariffs, transmission constraints, concerns about basis risk, severe weather, insurance costs, and high financing rates. These factors – in addition to record high corporate interest in long-term corporate contracting for to-be-built, utility-scale renewable energy – led to VPPA pricing remaining high in the U.S. market overall in Q3 2024. SR Inc has seen early signs of easing solar supply chain pressures contributing to VPPA price stability or even price reductions but will be monitoring tariff expansions, progress towards onshoring domestic module manufacturing capacity, and, of course, any impacts from the November elections throughout 2024.

The growing concern about the reputational risks of unbundled RECs has been driving the increasing demand for purchaser caused RECs (a REC generated from a project caused by its procurement as part of a long-term transaction that enabled the project to get financed) for a few years now. Corporates are demonstrating a willingness to pay for more credible RECs from which they have unequivocal claims to having helped cause new renewable energy capacity to be built. Following the steep increases in VPPA prices in 2023, the increases have been more modest in 2024. The modeled cost of buyer favorable, VPPA-sourced RECs (i.e., what SR Inc Member-Clients call purchaser caused RECs) rose $4.95 per REC on average across wind and solar in all U.S. hubs over the last year as the volume of closed VPPA transactions remains high (closed deals averaged 14GW/year in 2021 through H1 2024). While a year ago, the average modeled U.S. VPPA had a cost of $11.46, the average modeled cost in Q3 2024 was $16.41 ($16.24 for solar and $16.58 for wind). SR Inc procurements achieve significantly better results than that as a result of the NZCB’s professionally-managed U.S. and European competitions, culminating in Reverse Auctions that are shaped to benefit corporate buyers.

Another factor SR Inc’s NZCB monitors closely is historical and projected earned wind and solar prices across hubs. In Q3, our 22-year earned price indicator decreased 10% for wind and decreased 11% for solar across active VPPA hubs compared to the prior quarter. The decrease in this indicator is largely attributed to a marked drop in gas prices and futures, which have a major influence on realized electricity prices and the electricity forecasts. SR Inc will be monitoring this indicator closely ahead of our Q4 index and will be looking for impacts from record high growth in electricity demand. Recent articles and studies from Bloomberg, the U.S. Energy Information Administration, ICF, Utility Dive, and the New York Times (and article 2 and article 3) have continued to highlight the surge in power usage driven by data center proliferation related to AI, continued movement to the cloud, cryptocurrency mining, onshoring of manufacturing, etc., which is driving unprecedented demand for both renewables and fossil fuels and will likely have an upward pressure on prices. Over the longer term, as the country electrifies and looks to emerging technologies like green hydrogen and battery energy storage, overall electricity demand is expected to continue to rise, increasing the need for clean energy and its associated infrastructure. This rise in demand is expected to provide a counterweight to downward price pressure due to low natural gas prices and more renewable energy and storage (with zero marginal costs) being added to the grid.

To better quantify VPPA market dynamics in the U.S., the NZCB has published the NZCB VPPA Opportunity Index quarterly since 2019 to help advance SR Inc’s mission to accelerate the development and adoption of best practices in more sustainable business. The NZCB VPPA Opportunity Index enables a comparison of potential wind and solar VPPA performance across U.S. hubs using common analytics. It reflects both prior actual (backcast) performance and forward carefully modeled pricing and is based on proprietary SR Inc analytics and key data sources including those provided by SR Inc data providers LevelTen Energy and REsurety. We call readers’ attention to the fact that the Index is based upon VPPA offers, not executed transactions, that were made over the prior quarter.

Key findings from SR Inc’s NZCB Q3 analysis (which exclude the new outlier of Maine solar) include:

- Top quartile offered wind VPPA prices across the country were up 8% on average from the previous 12 months, while offered solar VPPA prices were up 6%.

- Realized electricity prices have continued to correct down to more historically typical levels. Average trailing 12 month (TTM) realized wind electricity prices in Q3 2024 were down 48% (to $19.53) across active hubs from the TTM in Q3 2023 and realized solar electricity prices were down 39% (to $27.92) from Q3 2023.

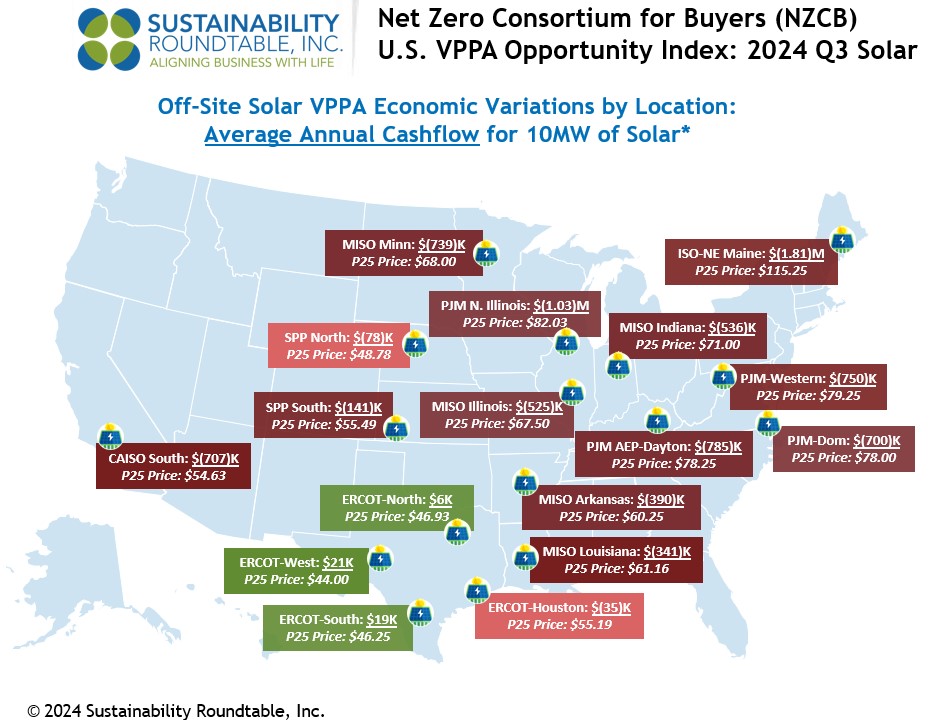

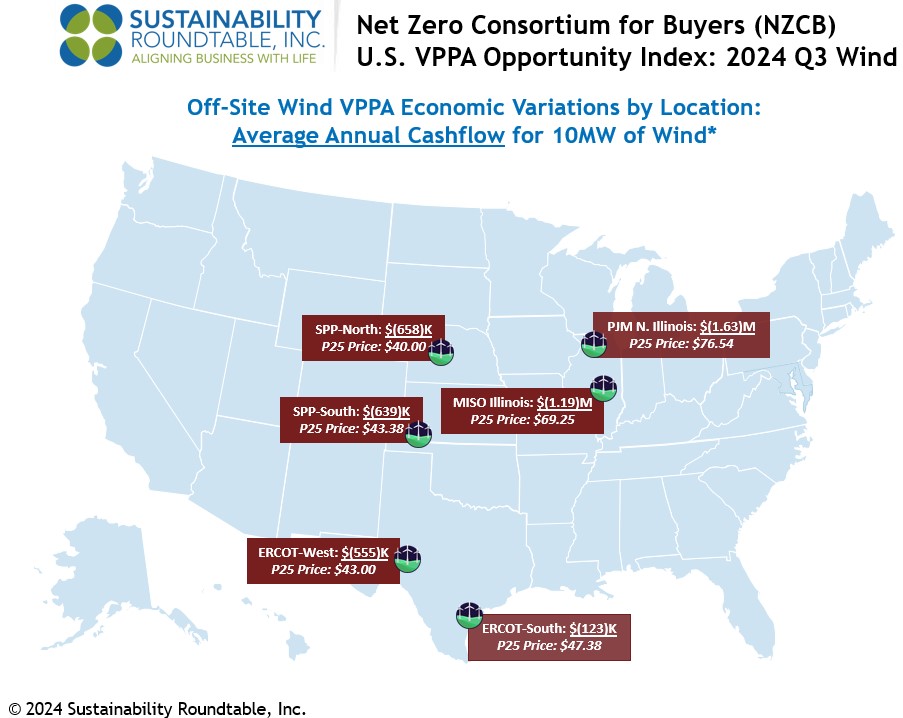

- The combination of higher VPPA prices and lower realized prices caused expected cashflows in the TTM for a 10MW wind VPPA to drop from $(461)K in Q3 2023 to $(1.21)M in Q3 2024 (drop of $753K) and expected cashflows for a 10MW solar VPPA to drop from $(293)K in Q3 2023 to $(825)K in Q3 2024 (a drop of $532K).

- Our longer-term view Opportunity Index shows that average modeled cashflow through Q3 2039 per 10MW VPPA across active hubs dropped $90K in Q3 (to negative $798K) versus Q2 2024 for wind and dropped $170K (to negative $419K) for solar.

- In Q3, wind VPPAs modeled to be less expensive in 17% of all active hubs versus buying far less impactful unbundled RECs (based on the typical average cost today of $4.39 for a 10-year strip of unbundled RECs), and solar VPPAs modeled to be less expensive in 31% of all hubs.

- The average modeled hub annual cashflow for a 10MW wind VPPA would have been $640K more expensive than buying the equivalent number of less impactful unbundled REC strip, and the average modeled hub annual cashflow for a 10MW solar VPPA would have been $314K more

- Price modeling shows that ERCOT solar presented modeled opportunities for better than breakeven cash flow in Q3. The average modeled ERCOT annual cashflow for a 10MW solar VPPA was $3K.

- For wind, price modeling continued to show that ERCOT South presented the best modeled opportunity in Q3, which was $(123)K per 10MW VPPA.

- To underscore the importance of NZCB’s procurement process, 2024 Q3 NZCB procurements for to-be-built solar were below the Q3 P25 VPPA prices for the same hubs despite also providing more than a dozen specially sought and secured buyer-favorable risk management terms required by conservative, environmentally motivated corporate procurement teams.

The NZCB VPPA Opportunity Index is an intentionally simplified rendering of complex markets, but NZCB participants find it helpful in beginning to gain an understanding of VPPA market dynamics and financial implications for implementing their renewable energy strategies through VPPAs and aggregated VPPAs. In pursuing any specific VPPA opportunities, SR Inc works with NZCB participants to provide deep stakeholder briefings and detailed and custom analytics before transacting. This type of assistance that VPPA offtakers need requires financial, legal, and market expertise to drive timely procurement strategy development and implementation, transaction structuring, contracting, and negotiation services, creating a successful and auditable corporate procurement process in rapidly changing markets.

- To calculate average annual cashflows, SR Inc multiplies 1) the difference of technology-shaped realized market prices (2017-2024) & forecasted technology-shaped electricity futures market prices (2024-2039) versus top quartile VPPA prices in each hub by 2) the typical total annual production for 10MW offtakes for wind and solar, respectively.

- SR Inc uses 36K MWh production per year for 10MW of wind and 24K MWh per year for 10MW of solar to provide “apples to apples” comparisons for both technologies across hubs.

- The top quartile VPPA price assumes a scaled offtake of at least 50MW, but SR Inc uses 10MW because it is typically the minimum individual corporate offtake required within 100+ MW aggregated procurements for NZCB participants.

Data Sources

- The NZCB Opportunity Index is developed from proprietary analytics and multiple data providers, which include:

- LevelTen Energy PPA Price Index North America top quartile VPPA pricing data for Q3 2024 (all proposed projects of 8+ years)

- REsurety CleanSight Discover actual average, technology-shaped realized market prices for Q4 2017-Q3 2024 and technology-shaped future market price forecasts for Q4 2024-Q3 2039 (as of October 18, 2024) based on multiple electricity futures markets.

If you have any additional questions, or would like to learn more about the NZCB, contact info@sustainround.com.