This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

May 12, 2015

Five Characteristics Shared By Member-Clients Leading the Way Towards More Sustainable Buildings & Business

SR Inc was pleased to announce Bloomberg as the Sustainable Business & Enterprise Roundtable’s (SBER) Outstanding Corporate Leader of 2014, and The Tower Companies as SBER’s Outstanding Landlord of 2014. Their impressive, profitable, achievements in more sustainable buildings and business are on par with the examples set by previous SR Inc Member-Clients recognized as Outstanding Corporate Leaders of the Year – Oracle (2013), Cisco (2012), and SAP (2011) – and Outstanding Landlords of the Year – Bentall Kennedy (2013), Brandywine Realty Property Trust (2012), and Brookfield Properties (2011).

What do these companies – that are leading the global move to more sustainably high performing corporate operations and real estate – have in common? From working with them (and more than seventy other multi-year SR Inc Member-Clients) over the past several years, our SR Inc Advisory Services team has observed five characteristics that define these outstanding leaders. SR Inc Advisors have found these five characteristics present across sectors, geography, and the tenant/landlord divide. Whereas many SR Inc Member-Client companies struggle to get sufficient funding for their sustainability efforts – at least before beginning with SR Inc – these leaders in sustainable operations and real estate do not face undue hardships in getting their sustainability initiatives resourced and recognized. As a result of this, it is not surprising they are increasingly recognized in the broader marketplace as leaders in more sustainable business as they drive growing margins as well as innovations of growing importance in a rapidly changing economy.

Why are these SBER Outstanding Leaders’ sustainability efforts better recognized and

resourced within their own firms? SR Inc Advisors believe it is because each of the following five characteristics contributes to a corporate culture that is enthusiastic about a more sustainable approach to buildings and business. Each of these characteristics deserves a fuller explanation than can be provided here, which is why SR Inc publications – including our Executive Guidance on Sustainability Strategy for Operations – and individual and multi-client sessions have addressed them (and hundreds of other relevant topics) in greater depth. Member-Clients can request a focused consultation on any one of them as they relate to the Member-Client’s enterprise. But it is possible to begin a public discussion about five characteristics SR Inc Advisors have regularly found to define top leaders’ approach to greater sustainability. Specifically, we have found that these leaders:

- Conceptually understand “corporate sustainability,” from C Suite to line manager;

- See a commitment to a more sustainable approach as helping them align with a growing concern of top customers, employees, investors and regulators;

- Recognize “corporate sustainability” as an unprecedented opportunity for corporate operations & real estate to shine;

- Are systematically interested in innovations for greater resource productivity;

- Have multi-year Sustainability Strategies that organize and animate their efforts.

#1 Embrace a More Sustainable Approach to Business (Not a Premium or Philanthropic Approach)

The first characteristic these companies share is the understanding that a more sustainable approach to business is, fundamentally, a more strategic approach to management. Furthermore, these companies understand what a sustainable approach to business is not. They realize that it does not necessarily require additional costs (even first costs) and it is not primarily philanthropic (although embracing it does benefit the communities and environment the company operates in). From the C-Suite to the level of building manager, these companies understand that a more sustainable approach to business is a superior approach to management in a world of rising resource constraints. When SR Inc Advisors analogize debates around the “costs” of Corporate Sustainability to debates around the “costs” of Quality a generation ago, it resonates with executives from these companies. Just as an organized commitment to Quality has come to be recognized as a part of how management functions – a part not regularly scored as incurring additional costs – these companies see an organized commitment to Corporate Sustainability as part of efficient management. These companies regularly report that an organized commitment to greater

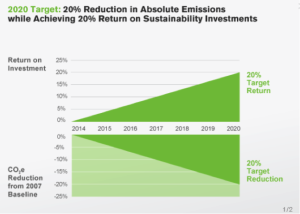

Source: Cisco 2014 Corporate Social Responsibility Report

corporate sustainability helps their enterprises systemize management’s consideration of a broader frame of analysis. As such, it helps management better “see” and act on previously underappreciated opportunities and risks because it is a wide enough frame of analysis to: (a) identify and define material non-cash items that shape an enterprise’s financial performance (through their impact on critical but hard to quantify items such as brand, employee engagement, productivity, innovation and risks); (b) incent and track performance relative to these important non-cash items; and, (c) allow for regular adjustment to account for the business context created by an increasingly global and resource constrained economy.

This perception of Corporate Sustainability as ‘an approach to business,’ is aligned with how the Dow Jones Sustainability Indices (DJSI) defined “Corporate Sustainability” back in 1999. That definition appeared below SR Inc employee email signatures for SR Inc’s first two years (2008-2010). That definition makes clear that “Corporate Sustainability” is all about “a business approach.” Specifically, the DJSI definition first published in 1999 asserts that “Corporate Sustainability” is “a business approach that creates long-term shareholder value by embracing opportunities and managing risks deriving from economic, environmental, and social developments.”

Consistent with this definition, leading companies see an organized commitment to greater sustainability as advancing the core profit mission of their company. Consequently, they can literally “invest” substantial financial resources in a more sustainable approach to their business. Recognition of the importance of rising resource constraints in regard to real estate, energy, materials, food, clean air, and clean water (not to mention competent regulation, security, public debt, culture and other social goods), enables these companies to align with top investors, top employees, top customers, and leading regulators who are increasingly concerned about how our globally booming consumer economy is increasingly taxing our planet’s system constraints. These companies do not see a more sustainable approach to business as a premium priced product. Instead, they see it as providing management with a “wider lens” that enables a fuller accounting of the non-cash factors such as health, productivity, brand, and regulatory risks – that can have short and long-term financial impacts. This “fuller accounting” of a more sustainable approach to business enables management to be more strategic as they seek to drive a growing margin in a changing world.

#2 Leverage Sustainability to Align & Engage with Top Customers, Employees, Investors & Regulators

The second characteristic these companies share is that they recognize how committing to sustainability can help them to more deeply align and engage with key stakeholders. And they see how a growing shared concerned for greater sustainability offers them “common ground” and a shared purpose through which to “speed to trust” with key stakeholders. Moreover, they are impressed with how Corporate Sustainability elegantly aligns a conventional commitment to continuous optimization and innovation with broader – and energizing – shared concerns.

These companies realize that sometimes a majority of certain key stakeholders – including customers – may not care about sustainability. But they consistently find that among those who do care, are especially attractive and strategic customers, employees and investors for their business. And their internal and external surveying indicates that the number of concerned customers, employees, investors and regulators grows each year. Easiest to track are the major cities and metropolitan areas around the world that set and adjust development processes and building codes which increasingly require or incentivize more sustainable operations. So, whether they are responding to questions from a large customer, a job candidate, a strategic investor or a regulator, these companies want impressive answers.

#3 Recognize the Unprecedented Opportunity for Corporate Operations & Real Estate Offered By Sustainability

The third characteristic these companies share is a recognition that the growing, global, interest in sustainable business is an unprecedented opportunity for corporate operations and real estate. Several multi-decade leaders in corporate operations and real estate have reported to SR Inc Advisors that they have never received so much attention from top management (or their own children – at least in relation to their work) until they made efforts towards an organized commitment to more sustainable operations and/or real estate. Perhaps more important, senior executives in corporate operations or real estate, many SR Inc Member Executives are responsible for a “cost center.” Thus, they are keenly interested not only in aggressively managing costs, but also in developing opportunities to create value for their companies.

The importance of sustainable operations is particularly pronounced for executives in service companies. Due to the lack of physical products, service companies focus sustainability efforts on operations. Year over year, service company executives are increasingly recognizing the powerful and relatively inexpensive opportunity that embracing “corporate sustainability” provides. A similar and related opportunity is also being increasingly recognized by real estate executives, who can be responsible for managing large real estate portfolios involving hundreds of millions of square feet in far flung municipal jurisdictions where sustainability only grows in importance.

Corporate sustainability efforts – which are all too often are funded by a marketing budget with to little corporate operations and real estate in-put – present a remarkable opportunity for corporate operations and real estate executives to advance a C-Suite interest. In addition to lowering operating costs, a sustainable operations strategy can support a number of C-Suite objectives including: better aligning and engaging with top talent, customers, investors, and regulators; reducing risks associated with climate change, resources price volatility and regulation. In this way, an organized commitment to greater sustainability imbues a conventional commitment to continuous optimization and innovation with the energy of social and environmental relevance. Employees are not turning off the lights, recycling and proposing innovative and sometimes radically more efficient approaches to “save management money.” They are doing those things and much more, at least in-part, to help their company be more responsible. All this helps corporate operations and real estate evolve from being “just” a “cost” to being seen as a value creator that is critical to employee engagement and an important part of a company’s brand.

#4 Use Sustainability to Drive Innovations for Greater Resource Productivity

Fourth, these companies love to innovate. And they especially like to do so in ways that add to top-line revenue as well as bottom-line performance. Senior executives at these companies take pride in their ability to innovate, which is second only to their pride in customer satisfaction. But their interest in innovation is often directed by personal and corporate commitment to greater sustainability that aligns their efforts at innovation with market drivers that helps ensure that when they do succeed it will be with an innovation of growing importance.

On a practical level, executives at these companies are eager to discuss their current pilot programs and their impressive ROI (or lack thereof) and are always interested in learning about the innovations of industry peers. In part because they recognize that for contemporary business to move fast enough towards greater sustainability, there most be more collaboration. They are especially interested in substantial new revenue and market opportunities for their companies that may be aided by the direct involvement of operations and real estate.

The best long-term Sustainability Strategies systemize this orientation towards continuous optimization and innovation. Indeed, establishing energizing sustainability goals (sometimes initially only internally) and developing a process that enfranchise senior management in identifying projects with a high relevant potential, piloting them and reviewing their performance, better positions these companies than their peers to resource and implement breakthrough projects. And they regularly do.

Our annual confidential management assessment and recommendation process for more sustainable corporate operations and real estate has for years helped Member Executives strengthen and refine their sustainability strategies. Across sectors and the corporate tenant/landlord divide, we have seen leaders set and meet increasingly bold and public sustainability goals. And we have repeatedly seen these bold commitments help drive operating and related new revenue innovations that have only grown in importance over the last several years as only more customers, employees, investors and regulators become only more concerned about resource constraints.

#5 Develop A Board Resonant Sustainability Strategy for Corporate Operations & Real Estate

Through working with our more than seventy world-leading companies and real estate owners and investors, SBER Advisors have seen a pattern emerge. Nearly all of our Member-Clients are recognizing the advantage of rolling disparate projects into a cogent “Sustainability Strategy,” and how doing this presents an unprecedented opportunity to be better recognized and resourced by the C-Suite.

Business case supported, multi-year, milestone-based Sustainability Strategies are proving to be a no capital cost “force multiplier” that enables enterprises to translate the noise of disparate efficiency and engagement programs into a signal senior management, top talent, top customers, top investors, and regulators can recognize and reward. By moving away from ad hoc projects, leaders are recognizing that sustainable business is about better aligning an enterprise with market drivers to deepen engagement with customers and talent, foster innovations of growing importance, reduce risks and increase margins in a changing world. Helping companies create comprehensive, Board resonant, enterprise and portfolio-wide sustainability strategies has become a major component of SR Inc’s service and we want to share with the broader market what these companies are finding efficacious.

When assisting Member-clients, we have found it helpful to break down the change management process involved in setting up and driving a Sustainability Strategy into five key components: Vision & Governance, Strategy, Guidance, Implementation and Reporting Results. We have found that leading companies demonstrate outstanding performance across all five of these areas. Over the course of the next weeks and months, SR Inc Advisors look forward to sharing publicly some of what we have learned over the years helping SBER Member-clients establish and drive effective Sustainability Strategies. We hope to provide a blog post on each of the components of an effective Sustainability Strategy detailed above. Meanwhile, we encourage any Member Executives who have not reviewed the SBER Full Report “Sustainable Buildings & Business: Executive Guidance on Sustainability Strategy for Operations,” to access it on our Digital Library and, if interested, request a consultation on any part of it or the many related scores of implementing Guides & Tools in the SBER Global Guidebook on Sustainable Real Estate & Facilities from your SBER Advisor.

Jim Boyle is CEO & Chairman of Sustainability Roundtable, Inc. (SR Inc). For more than six years, Jim has led full-time teams of diverse experts assisting world-leading corporations, real estate owners, and federal agencies in their move to greater sustainability. Before founding SR Inc., Mr. Boyle advised fast growth technology firms, private equity firms, and institutional investors as an advisor on real estate strategy and implementation, and before that, as a large law firm attorney assisting corporate and investment clients on complex real estate and environmental compliance-related issues. He has led in developing SR Inc’s confidential, sector-industry specific, annual management assessment and recommendation process for more sustainable operations and real estate that is compatible with major public standards globally. Further, he has directed the development of hundreds of pieces of SR Inc original Executive Guidance, Implementation Guidebooks, Solution Assessments, and Tools to assist SR Inc Member-Clients in their move to more sustainable business. He is a graduate of Middlebury College and Boston College Law School, and early in his career, he served as a federal law clerk and as an aide to John F. Kerry in the United States Senate.

Jim Boyle is CEO & Chairman of Sustainability Roundtable, Inc. (SR Inc). For more than six years, Jim has led full-time teams of diverse experts assisting world-leading corporations, real estate owners, and federal agencies in their move to greater sustainability. Before founding SR Inc., Mr. Boyle advised fast growth technology firms, private equity firms, and institutional investors as an advisor on real estate strategy and implementation, and before that, as a large law firm attorney assisting corporate and investment clients on complex real estate and environmental compliance-related issues. He has led in developing SR Inc’s confidential, sector-industry specific, annual management assessment and recommendation process for more sustainable operations and real estate that is compatible with major public standards globally. Further, he has directed the development of hundreds of pieces of SR Inc original Executive Guidance, Implementation Guidebooks, Solution Assessments, and Tools to assist SR Inc Member-Clients in their move to more sustainable business. He is a graduate of Middlebury College and Boston College Law School, and early in his career, he served as a federal law clerk and as an aide to John F. Kerry in the United States Senate.