This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

May 14, 2018

Why It’s time to Make the Business Case for 100% Renewable Energy

By now, most of us are familiar with the charts showing the precipitous drop in price for renewable energy technologies – a rate of decline far outpacing the predictions of energy forecasters and environmental advocacy groups alike. The strength of the US market for corporate renewable energy procurement has been unwavering in the face of an administration that stands proudly against environmental regulation. This fact has been repeatedly proved out by the rapidly growing group of multinational companies committing to power 100% of their global operations with renewable energy. With the economics of utility-scale renewable energy being so favorable, and the aggregation of corporate demand for renewable energy projects allowing many more companies to access these favorable economics, now is the time to make the case to go 100% renewable.

RE100 – a collaborative of The Climate Group and CDP aimed at uniting influential business committed to 100% renewable electricity – saw a 40% growth in its membership in 2017. According to the RE100’s latest report, “RE100 members have a collective revenue of over US$2.75 trillion and operations spanning six continents. Together they represent over 159TWh of demand for renewable electricity – more than enough to power Malaysia, New York State or Poland, and equivalent to the 24th largest electricity demand of all countries.”1

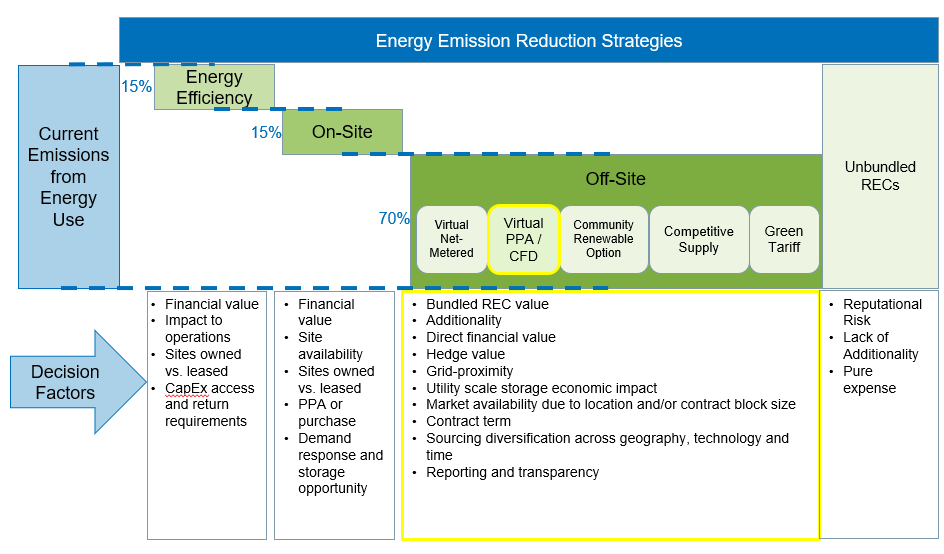

Have these 134 (and counting) companies committed to these bold renewable energy goals strictly for the branding benefits? Hardly: 88% of responding RE100 members cited the economic case as an important driver for their commitment to 100% renewable energy. Far from being the moonshot it once was, nailing down a strategy to source 100% of a company’s electricity from renewable sources is today eminently doable. Figure 1 below illustrates the range of strategies companies employ to reduce carbon emissions from the electricity they consume. As the figure shows, energy efficiency and onsite renewable energy each account for approximately 40% of a company’s emissions reduction opportunities. However, limitations including available CapEx, investment return requirements, and site availability lead companies to reduce most of their Scope 2 emissions via off-site renewable energy purchases. A growing array of contract structures enabling the purchase of off-site renewable energy make it increasingly accessible to companies ranging in size and energy demand.

Specifically, a virtual Power Purchase Agreement (vPPA) structured as a Contract for Differences (CFD) provides companies with Renewable Energy Certificates (REC) bundled to the energy produced at a specific renewable energy power plant – a power plant that would not have been built but for the financing support of the corporate buyer. Between 2015 and 2016, the increase in direct procurement of renewable energy from offsite PPAs grew fourfold among RE100 members, totalling 4.8 TWh annually.2 As reported in GreenPeace’s Clicking Clean: Who Is Winning the Race to Build A Green Internet?: “Most IT companies have already shifted away from pursuing Unbundled REC products as a central strategy due to the lack of impact in displacing fossil fuel generated electricity from the grid and the lack of any economic benefit in the form of a hedge against rising electricity prices to the buyer.” The Report continues with an example: “Microsoft, who had previously relied heavily on Unbundled RECs as a means of achieving its “carbon neutral” claim, has been gradually shifting to higher impact purchasing strategies such as PPAs, where the electricity and the RECs are sold together, providing sufficient guaranteed revenue to drive new renewable energy deployment.”3 (For more detail on the value of Bundled versus Unbundled RECs, see our blog post on the subject here).

Not only are Bundled RECs significantly more valuable in the eyes of standard setters and other engaged stakeholders; procuring renewable energy via a CFD also enables companies to procure more credible RECs at a profit – even in year one. As Laura Abasolo, Chief Finance and Control Officer for Telefónica reports, “Renewable targets allow us to improve efficiency, while we run our business in a sustainable way, maximizing returns to our shareholders that care about results, as much as how we achieve them. Furthermore, we expect savings of 6% on the energy bill in 2020 and up to 26% in 2030 thanks to our Renewable Energy Plan.”4

Unlike the traditional purchase of Unbundled RECs, which will always cost a company money, a CFD opportunity that is accurately assessed and carefully negotiated can yield Bundled RECs at a negative cost, as the Bundled REC “price” is determined by measuring the net difference between the agreed VPPA Price and the wholesale market price of energy. A sustained positive difference between the market price and the VPPA Price will lead to significant positive cash flows for the Bundled REC buyer. A growing number of companies are moving to capitalize on this and the many additional benefits of VPPAs (for a detailed explanation of the benefits and risks of VPPAs, see our blog post here.) According to the Rocky Mountain Institute’s Business Renewables Center (of which SR Inc is a proud sponsor), about five dozen companies have caused a remarkable 10+ GW of large scale renewable energy to be developed over the past 5 years.

Further underscoring companies’ faith in and enthusiasm for the renewable energy market, as of this writing, 410 companies have committed to Science Based Targets, which are those adopted by companies to reduce GHG emissions in line with the level of decarbonization required to keep global temperature increase below 2 degrees Celsius compared to pre-industrial temperatures.5 Not only does this number far surpass the Science Based Targets Initiative’s initial goal to sign 250 companies on by 2020; it also demonstrates a new way of thinking around GHG reduction goals. Historically, corporations have been cautious to set goals only after carefully assessing what is indubitably feasible through energy efficiency, onsite renewable energy, and traditional PPAs. However, the increasingly attractive and accessible offsite renewable energy market has enabled some companies to leap before they look with well-founded confidence that they’ll be able to achieve those ambitious goals (although the majority of the companies we advise still prefer an evidence-based approach to goal-setting.)

As Mike Power, Chief Operating Officer for Technology and Operations at DBS Bank, points out, “the case for businesses to adopt renewable energy at scale is clear and becoming more compelling all the time. Companies need to ‘get with the program now’ or risk losing relevance to their customers.”6 We’re working with clients week in and week out to help them make the case to go 100% renewable and bring their company increased innovation, reduced regulatory uncertainty, strengthened investor confidence, and improved profitability and competitiveness. Don’t hesitate to contact us to learn how world leading Member-Clients are – right now – proudly charting a course to profitably go 100% renewable.

1 https://www.theclimategroup.org/sites/default/files/re100_annual_report.pdf

2 Ibid

3 http://www.clickclean.org/usa/en/

4 https://www.theclimategroup.org/sites/default/files/re100_annual_report.pdf

5 http://sciencebasedtargets.org/what-is-a-science-based-target/

6 https://www.theclimategroup.org/sites/default/files/re100_annual_report.pdf

As Senior Manager of Research & Consulting, Kelsey Wallace supports members of SR Inc’s confidential, strategic advisory & support service in their move to more sustainable high-performance. With several years experience at the intersection of business and sustainability, Kelsey provides specialized program assistance to clients on a one-to-one basis, supporting all aspects of strategy development and implementation for management teams overseeing corporate sustainability strategies, policies and projects. Prior to joining SR Inc, Kelsey worked for The Cadmus Group, where she provided technical support to the Environmental Protection Agency and US Green Building Council on projects to improve the sustainability of federal infrastructure. Kelsey also devoted a year to national service with the AmeriCorps National Civilian Community Corps, where she worked on team-based conservation and community development projects throughout the Southwest United States. Kelsey has her B.A. in Environmental Studies from Connecticut College.