This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

June 30, 2020

CDP – Three Letters that Spell: Time Consuming & Necessary

CDP has become the undisputed category leader for providing the comparable metrics that are crucial for any scalable global system for corporate responsibility. Because rating systems like CDP inspire companies to both ingrain sustainability into their governance structures and to outperform their peers, they have a critically important role to play in our global challenge of human-caused climate breakdown. Having worked with more than 75 Fortune 500 and growth companies on a multi-year basis, SR Inc has witnessed firsthand how leading companies use iterative CDP filings to help guide the development of best-in-class environmental, social, and governance (ESG) and sustainability programs and improve their scores. Although many of the ESG, sustainability, and CSR executives we work with are overwhelmed by the multiple competing global standards and the time and data analysis they require, CDP is well worth the effort.

CDP (formerly the Carbon Disclosure Project, but now also focused on water usage, deforestation, and supply chains) helps companies measure and disclose the effective management of carbon by collecting information on climate risks and low carbon opportunities on behalf of over 525 institutional investor signatories with a combined $96 trillion in assets. As of this year, CDP is now in full alignment with the Taskforce on Climate-related Financial Disclosures (TCFD) – which encourages the full consideration of all risks and opportunities global climate change presents – meaning that reporting to CDP is a way for companies to meet the suggestions of TCFD that institutional investor BlackRock is now asking all of its companies to fulfill. Filing with CDP can also align well with corporate Global Reporting Initiative (GRI) reporting, that many companies also find are table stakes these days.

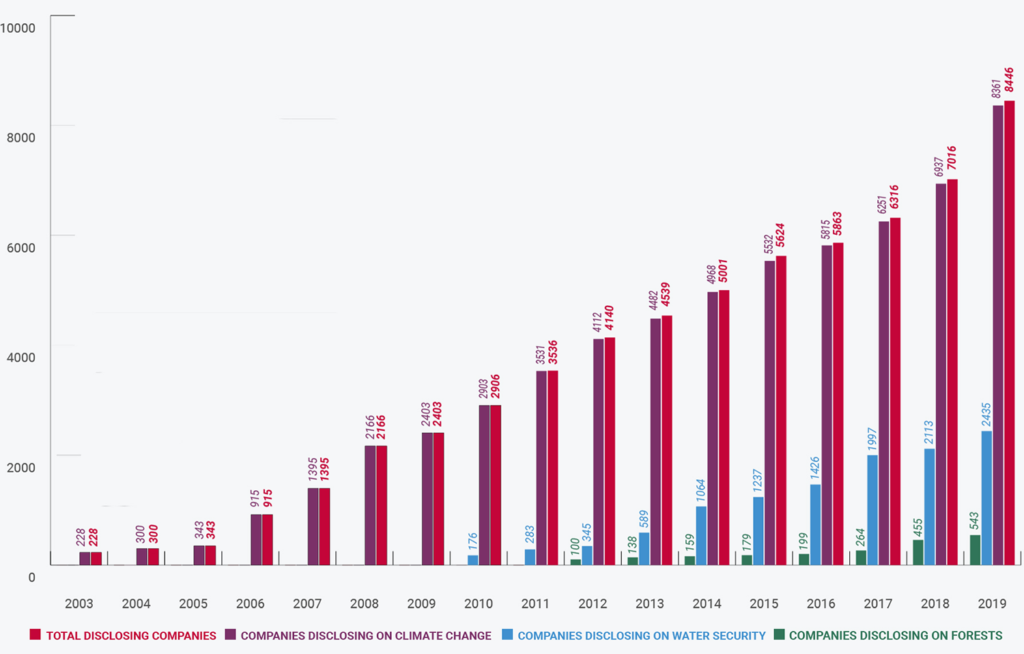

As shown in the figure below, in 2019, over 8,400 companies representing over 50% of global market capitalization disclosed through CDP (along with 920 cities, states, and regions). CDP is indisputably the leading provider of comparable metrics and related data globally. Given that CDP reporting has witnessed impressive growth year over year, companies not reporting to CDP will soon be in the minority.

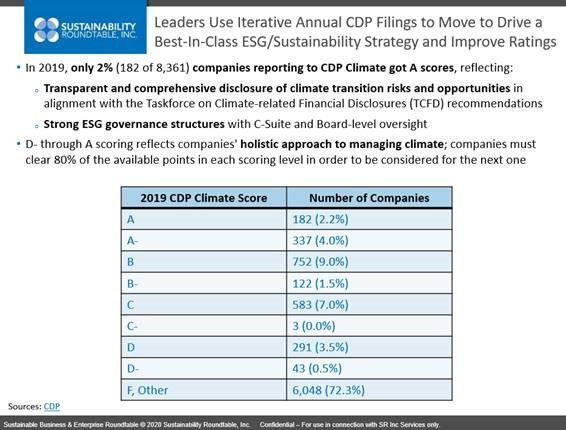

SR Inc Member-Clients American Express and Cisco Systems made the CDP “A List” in 2019, while other clients like Oracle and Lenovo were not far behind, each with an A-. This is quite remarkable given that, as shown in our summary figure below, only 6% of all responding companies scored in the A Leadership level in 2019. Each of these Member-Clients have used CDP to advance their ESG missions, using the desire to improve their scores to develop industry-leading ESG governance structures and programs. These benefits far outweigh any “pain” caused by the CDP filing process.

According to CDP’s press release in January of the 2019 A List, “the A List has outperformed its global benchmark by an average of 5.5% per annum over a seven-year period. This indicates that transparency and leading action on climate change are correlated with financial success…The A List companies are considered leaders because of their transparent and comprehensive disclosure of climate data, thorough awareness of climate risks, demonstration of strong governance and management of those risks, and demonstration of market-leading best practices [like] setting science-based targets, shifting to renewable energy, investing in low-carbon product innovation, using internal carbon pricing or incentivizing suppliers to reduce their emissions.”

Bruno Sarda, President of CDP North America, remarked: “CDP’s A List showcases companies that model true corporate sustainability leadership and are forging forward to become environmentally and financially sound companies…While climate change is already upon us, these companies know sustainability presents an exciting race to the top, an opportunity to innovate and rethink business as usual.”

SR Inc is currently helping Member-Clients advance their scores and develop recommendations for improving ESG management within their companies using CDP as a guide. As a former Member-Client at a F500 tech company told SR Inc, “there is no question my greatest value-add in 3 years here is getting them to a CDP A, which contributed to the process that enabled the company to win a spot on the DJSI.” We welcome the opportunity to discuss with current and potential Member-Clients how SR Inc can help your company improve ESG risk management, identify business opportunities, and develop strong ESG governance structures.