This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

June 22, 2020

Covid-19 Is the Ultimate ESG Issue

SR Inc’s Virtual 2nd Quarter Symposium Includes Discussion on the Importance of Strong ESG Management in Responding to Rapidly Emerging Issues like the Coronavirus and Racial Unrest

SR Inc held its second quarter Sustainable Business & Enterprise Roundtable (SBER) Executive Symposium, originally scheduled to be in San Francisco, over Cisco WebEx on June 18th. Attendees heard from three leading executives at SR Inc Member-Client companies: Mike Mattera, Director of Corporate Sustainability at Akamai Technologies, Sean Kinghorn, Global Sustainability Leader at Intuit, and Andy Smith, Senior Manager of Global Energy Management & Sustainability at Cisco Systems.

A key theme throughout the first half of the Symposium was the concept of dynamic materiality. Dynamic materiality recognizes that emerging issues can quickly shape how key stakeholders – like customers, employees, and host communities – make decisions about a company. When these issues emerge, they can quickly become material to a company’s financial investors. Therefore, current SEC regulations and related case law would suggest it is necessary for publicly traded companies to track and report efforts to manage these issues. The Covid-19 crisis may represent the ultimate example of dynamic materiality since managing the related risks has become an urgent priority for most customers, employees, suppliers, host communities, and, therefore, companies.

Writing for Forbes, Harvard Business School professor Bob Eccles (currently a visiting scholar at the Said Business School in London) highlighted the crisis of plastic pollution in the oceans as an example of an issue that quickly came to affect decisions of certain consumers. In a follow-up article, Eccles writes that the Covid-19 crisis represents a more dramatic example of dynamic materiality. Dynamic materiality is critically important because what environmental, social & governance (ESG) issues a company determines are material to its success become the focus of ESG management and reporting efforts. Over the last several years, ESG has skyrocketed to a CEO-level concern regularly managed by an ESG or Corporate Sustainability Committee that directs, tracks, and reports the company’s efforts on material ESG issues to investors.

As 2020 began, the interest in ESG-conscious funds grew from a rush to a stampede as over $30 trillion in global assets under management became subject to some kind of ESG screen. Five years earlier, Harvard Business School professor George Serafeim and colleagues published Corporate Sustainability: First Evidence on Materiality, which reflected their rigorous analysis on whether high performance on industry-specific ESG items [identified by the Sustainability Accounting Standards Boards (SASB)] were, in fact, financially material to investors. Serafeim concluded that the share value of companies with strong ESG programs outperform peer companies when normalized for size, age, and other factors. This helped turn conventional wisdom on its head and established that ESG-conscious investing was not only not concessionary but could also be an effective strategy for higher alpha returns.

By January of this year, Larry Fink of BlackRock (the CEO of the world’s largest investor) again underscored the importance of ESG in his annual letter to the 2,700 companies in which BlackRock invests. Fink told companies that they must track and report their management efforts regarding SASB-identified, industry specific ESG issues in a manner aligned with the Taskforce on Climate-Related Financial Disclosures (TCFD) and warns that non-compliance would lead to the possibility of shareholder action from BlackRock. Going even further, Fink shared that in response to overwhelming evidence that ESG high-performance is correlated with higher shareholder returns, BlackRock would increasingly use ESG-related analysis as part of its fundamental approach to investing.

As Fink was making this request, a highly infectious novel coronavirus had spread to human hosts throughout the sprawling urban communities of Wuhan and China. The Coronavirus was also being transported around the world by traveling, infected citizens of Wuhan – many of whom may have been asymptomatic. In the weeks that followed, news of this quick spreading virus impacted global financial markets and was initially perceived as a risk for companies with Chinese-dependent supply chains. But by the giant sell offs in early March, investors had come to recognize Covid-19 as a challenge to business operations everywhere.

In this environment, the ESG investment thesis – namely that companies that outperform peers in managing ESG risks and opportunities will outperform peers in shareholder performance – began to prove itself. In the painful global sell-offs in March, ESG high performing companies outperformed peers in share value. The well noted “flight to quality” in bear markets overlapped with investors staying invested in ESG high performers; as a Bank of America report found in March, “ESG is a bear market necessity, not a bull market luxury.”

Although global authorities influential in the field of corporate sustainability such as the World Economic Forum (described later in the blog) had long recognized the threat infectious diseases pose to global supply chains, the outperformance of ESG high performing companies in share value did not appear attributable to their superior managing of Covid-19 risks. Rather, the strong correlation between ESG high performers and strong share value performance during Covid-19 seems to be attributable to the fact that investors favor high quality (and ESG high performing) companies in uncertain markets.

As we move out of the first six months of the Covid-19 crisis, it is likely that many companies will look to systemize how they address the risks and opportunities created by this crisis. Companies will likely want to move responsibilities to address Covid-19 and new pandemic-related risks beyond any emergency Covid-19 task forces. When this happens, many companies will likely recognize that the ESG or Corporate Sustainability Committee is the right “organizational home” to manage infectious disease-related risks. This is because Covid-19 is the ultimate ESG issue, as illustrated by these five reasons:

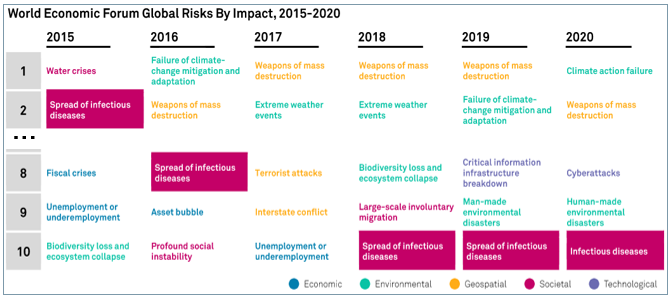

- Although Covid-19 is exogenous to the company and market, it presents risks to both. Starting in 2006 when it first published its annual Global Risk Report, the World Economic Forum has listed infectious diseases and/or pandemics as one of the top 10 global risks (see the graphic below). The 2006 report seems awfully prescient today, stating that pandemics “may disrupt our global society and economy in an unprecedented way and claim human life at levels close to the 1918-1919 Spanish Flu pandemic.” Due to the impacts of the H1N1 flu and Ebola crisis, the spread of infectious diseases jumped to the #2 global risk in 2015. Many leading companies have taken the risk of global pandemics seriously and had been preparing for it long before it became a major issue in the U.S. this March. For example, one SR Inc Member-Client set up a Covid-19 committee in January to begin planning for if, when, and how it would respond to outbreaks in its global host communities. By taking the threat seriously early on, this Fortune 100 company was able to maintain global operations in an organized fashion by equipping 60,000 employees to work remotely and committed to avoid any layoffs through 2020.

- Covid-19 is material to key stakeholders including employees, customers, and host communities. Truvalue Labs created a free Coronavirus ESG Monitor, shown in the figure below, to capture the pandemic’s impact using the SASB material issue categories. The Monitor shows that Covid-19 has only increased the importance/materiality of these ESG issues to key stakeholders. Employee health & safety, labor practices, access & affordability, product quality & safety, supply chain management, and GHG emissions are the material categories that have seen the greatest increase in relevance amid the pandemic.

- Covid-19 requires systemic engagement with key stakeholders to create needed and shared value. Many organizations, like JUST Capital and Forbes, are tracking companies’ response towards key stakeholders during the pandemic. For example, Wells Fargo is listed on Forbes’ list of top 25 U.S. employers’ responses to the pandemic. According to Forbes, the bank:

- Announced $175 million in donations for communities, small businesses, and vulnerable populations most impacted

- Closed 25% (~1,400) of its branches and updated its U.S. medical plan to eliminate out-of-pocket costs for necessary Covid-19 screening and testing

- Shipped hand sanitizer, disinfectant wipes, masks, bandanas, and other items to workers still reporting to an office and intensified cleaning procedures

- Offered payment arrangements and a 90-day deferral to students and other lending customers

- Covid-19 is a long-term risk that can only be understood and managed with respect for science. For example, as highlighted in our previous blog post, it is not an accident that the 75,000-employee Partners Healthcare hospital system in hard-hit Massachusetts experienced few workplace transmissions even when 75% of employees remained working on-site. They relied on a five-pillar strategy of screening, hygiene, distancing, masks, and culture change to effectively minimize risks in accordance with the leading science.

- It will be necessary to track and report how Covid-19 risks are managed. As described in a recent BSR article, stakeholders will eventually look back at how companies responded to Covid-19 from an ESG perspective, and companies need to provide the information that allows them to effectively do so. Whether that is through an integrated report, a dedicated TCFD report, or in a SASB or GRI-aligned sustainability report, companies need to explain how they are managing Covid-19 related risks in the workplace and supply chain and for their customers and host communities. Future SR Inc blog posts will also discuss the reporting implications of Covid-19 on emissions, business travel, commuting, and recycling targets and programs.

Conclusion

Corporate commitments to systemized and reported management of ESG issues was growing dramatically at the outset of 2020. The last few months have brought extra-financial exogenous issues like the Coronavirus and the needed and swelling demands for racial equity to the fore as well. As companies effect the acute changes required by Covid-19 and systemic racism, many will recognize that vaccines and anti-racism are unlikely to eradicate these issues that are increasingly and decisively important to key stakeholders. The “new normal” will undoubtedly include the systematic consideration of the risks and opportunities created by the increasing likelihood of pandemics and the legacy of racism in this country. The fact that pandemics dramatically impact vulnerable communities the most will contribute to needed and increasing demands for racial equity. Consequently, the most effective corporate ESG Committees will oversee, direct, drive, and report a systematic engagement with customers, employees, suppliers, host communities, and investors that recognizes Covid-19 and related challenges as the ultimate corporate ESG challenge and opportunity.

Jim Boyle is CEO & Founder of Sustainability Roundtable, Inc. For more than ten years, Jim has led full-time teams of diverse experts to assist nearly 100 Fortune 1000 companies on a multi-year basis in their move to more sustainable high-performance. Specifically, SR Inc has helped world-leading corporations, real estate owners and federal agencies to Set Goals, Drive Progress & Report Results in greater Corporate Sustainability. Mr. Boyle led in the creation of SR Inc’s Renewable Energy Procurement Services (REPS), which advises and represent Fortune 1000 Member-clients and fast growth technology companies across the U.S. and internationally in the development of Renewable Energy Strategies and the procurement of both on and off-site advanced energy solutions. Before founding SR Inc, Mr. Boyle co-led Trammell Crow Company Corporate Advisory Services in San Francisco and returned to his native Boston and Trammell Crow Company’s market leading team in Greater Boston where he received the Commercial Brokers Association’s Platinum Award for the highest level of commercial real estate transactions. Earlier, he advised companies on real estate and environmental matters as as attorney at a large law firm based in Boston. Jim is a graduate of Middlebury College where he co-captained the football team and Boston College Law School, who early in his career served as a federal law clerk, an aide to John F. Kerry in the U. S. Senate and on Vice President Al Gore’s campaign for President.

Jim Boyle is CEO & Founder of Sustainability Roundtable, Inc. For more than ten years, Jim has led full-time teams of diverse experts to assist nearly 100 Fortune 1000 companies on a multi-year basis in their move to more sustainable high-performance. Specifically, SR Inc has helped world-leading corporations, real estate owners and federal agencies to Set Goals, Drive Progress & Report Results in greater Corporate Sustainability. Mr. Boyle led in the creation of SR Inc’s Renewable Energy Procurement Services (REPS), which advises and represent Fortune 1000 Member-clients and fast growth technology companies across the U.S. and internationally in the development of Renewable Energy Strategies and the procurement of both on and off-site advanced energy solutions. Before founding SR Inc, Mr. Boyle co-led Trammell Crow Company Corporate Advisory Services in San Francisco and returned to his native Boston and Trammell Crow Company’s market leading team in Greater Boston where he received the Commercial Brokers Association’s Platinum Award for the highest level of commercial real estate transactions. Earlier, he advised companies on real estate and environmental matters as as attorney at a large law firm based in Boston. Jim is a graduate of Middlebury College where he co-captained the football team and Boston College Law School, who early in his career served as a federal law clerk, an aide to John F. Kerry in the U. S. Senate and on Vice President Al Gore’s campaign for President.

As Manager of Research & Consulting at SR Inc, Jeff Meltzer provides outsourced program assistance to clients on a one-to-one basis, helping CSR, operations, and sustainability executives set goals, drive progress, and report the results of their sustainability programs. Jeff holds a Master of Environmental Management from Duke University’s Nicholas School of the Environment and a B.A. in Environmental Policy from Colby College. He has relevant work experience with the Procurement and Property Services team at Citizens Bank as an EDF Climate Corps Fellow, with the EHS and Sustainability team at L’Oréal, and with the EPA Green Power Partnership as an Environmental Analyst at Eastern Research Group. He has client project experience with Biogen, helping the company develop a Scope 3 supplier engagement strategy to achieve its Science-Based Target. Jeff is also an active participant in sustainability groups, is an accredited LEED Green Associate, is trained in the GRI Standards and GHG Protocol, was the Co-President of the Duke’s Net Impact club, and is an active member of the Net Impact Boston leadership team.

As Manager of Research & Consulting at SR Inc, Jeff Meltzer provides outsourced program assistance to clients on a one-to-one basis, helping CSR, operations, and sustainability executives set goals, drive progress, and report the results of their sustainability programs. Jeff holds a Master of Environmental Management from Duke University’s Nicholas School of the Environment and a B.A. in Environmental Policy from Colby College. He has relevant work experience with the Procurement and Property Services team at Citizens Bank as an EDF Climate Corps Fellow, with the EHS and Sustainability team at L’Oréal, and with the EPA Green Power Partnership as an Environmental Analyst at Eastern Research Group. He has client project experience with Biogen, helping the company develop a Scope 3 supplier engagement strategy to achieve its Science-Based Target. Jeff is also an active participant in sustainability groups, is an accredited LEED Green Associate, is trained in the GRI Standards and GHG Protocol, was the Co-President of the Duke’s Net Impact club, and is an active member of the Net Impact Boston leadership team.