This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

September 25, 2020

The Alphabet Soup of ESG Reporting – It’s Elementary

Although general business news in the U.S. 2020 has been dominated by Covid-19 and businesses’ response to the Black Lives Matter movement, another far more technical development in the field of corporate Environmental, Social & Governance (ESG) has also prompted important change across industries and sectors. There has been a stampede of Corporate Social Responsibility (CSR) executives working hard to understand how they can evolve years long “CSR programs” into “ESG Strategies” designed and publicly reported by companies to resonate with investors as well as CSR’s traditional audience of customers, employees and host communities.

As a result, CSR executives (if companies have them), Corporate Affairs and General Counsel from many companies without organized ESG Strategies have been getting a crash course in the “alphabet soup” of global standard setters for Corporate Sustainability. Which is a field that is more than thirty years in development but suddenly evolving from being the province of the Fortune 500 and publicly traded growth firms to being applicable to all sophisticated companies (see below Bob Massie’s “Welcome to the ESG Evolution”). Fortunately, Corporate Sustainability and the alphabet soup of global standards developed over the last generation to help advance it, is much more confusing initially than after a patient examination of its development, institutions, processes and expectations.

What Created the Stampede in 2020 to ESG Management & Reporting?

In January of this year, just before Covid-19 emerged as the global pandemic experts long warned about – Larry Fink, CEO of Blackrock (the world’s largest investment management firm with $6+ trillion under management) sent a letter to the 2,700+ companies Blackrock invests requesting that CEOs take responsibility for reporting on Environmental, Social and Governance (ESG) issues. Fink’s letter to portfolio CEOs has become an annual event in the field of Corporate Sustainability over the last several years and it reflects the far wider growth of ESG conscious investing that SR Inc has noted in the Sustainable Leadership blog several times. Far more than in years past, however, Fink’s letter this January was specific and threatened shareholder action by Blackrock, if not respected. The letter requested the CEOs be responsible for ESG reporting aligned with the Sustainability Accounting Standards Boards (SASB) industry specific identification of ESG items material to financial investors and with the Task Force on Climate-related Financial Disclosure (TCFD) guidance on identifying climate related risks. Unsurprisingly, this prompted many companies to seek to understand these and related standards in ESG management and reporting.

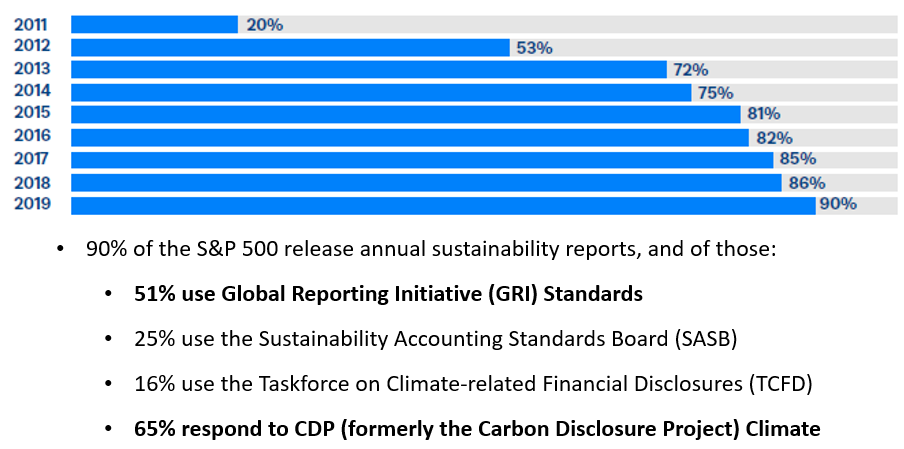

In a blog post earlier this summer, SR Inc defined CDP as Three Letters that Spell: Time Consuming & Necessary. For more than twenty years, rating systems and reporting frameworks like CDP have encouraged companies to both ingrain sustainability into their governance structures and to outperform their peers. While many companies and stakeholders view CDP as the most important ESG reporting framework, it is far from the only popular one. As shown in the figure below, a recent report from the Governance & Accountability Institute finds that 90% of the S&P 500 reports annual on their ESG efforts, with 65% of those responding to CDP, 51% using the Global Reporting Initiative (GRI), 25% using the Sustainability Accounting Standards Board (SASB), and 16% using the Taskforce on Climate-related Financial Disclosures (TCFD).

Bob Massie’s “Welcome to the ESG Evolution” from 2016 in Institutional Investor provides a cogent summary of the development of global standard setters in more sustainable business. In the article, Massie provides a first person account of the founding of several global reporting frameworks and related standards. Massie notes that when he Co-founded the GRI in 2002, there were hardly any ESG frameworks and rating systems. But as SustainAbility’s Rate the Raters noted in 2018, there are now more than 600. This explosive growth was driven by client demands for investors to use more extensive ESG reporting to improve investment decisions. While investors now have more information than ever to make those informed decisions, many operating executives in companies are confused by what surveys to respond to, what rankings to pay attention to, and how to report in general. Fortunately, multiple efforts to consolidate and streamline the reporting process continue to proceed. Just this month, five leading sustainability and integrated reporting organizations – CDP, CDSB, GRI, IIRC and SASB – announced a Statement of Intent to Work Together Towards Comprehensive Corporate Reporting.

How complicated the multiple, overlapping, decades in development global reporting frameworks, standards and rating systems are can be overstated. Particularly by private research and rating agencies promoting their own, distinct, ranking system. Since ESG reporting frameworks, standards and ratings are generally designed for and marketed to financial investors, they can seem particular obtuse to operating executives. This leaves corporate managers responsible for developing, driving and reporting ESG Strategies to be educated by consultants who have often not spent years working with ESG frameworks and standards. Furthermore, these consultant are regularly paid by the hour and, therefore, lack a clear incentive to provide efficient and simplifying advice.

Consequently, SR Inc Advisors regularly find it helpful to explain the proliferating constellation of global frameworks, standards and rating systems in relatively simplistic terms (at least initially) and to highlight the most important global standard setters. While explaining the largely complementary nature of a small handful of leading and needed – mostly non-profit – institutions. See below a deliberately simplistic take on selected standard setters:

- GRI – The framework for multi-stakeholder reporting. The Global Reporting Initiative (GRI) has succeeded in establishing the need for a regular “Materiality Analysis” to determine what enterprise’s multi-stakeholders such as its customers, employees and host communities consider material to their collaborative value creation. Publishing a Sustainability/ESG Report that is aligned with the GRI framework helps companies organize their ESG program priorities internally while also conveying to key stakeholders that the company takes ESG issues seriously. There are over 38,000 GRI reports in GRI’s online database.

- CDP – The environmental metrics and dataset. The CDP (formerly the Carbon Disclosure Project) provides the world’s most comprehensive dataset based on comparable metrics that has become the worldwide standard for climate, water, and deforestation reporting with 20+% annual growth and 8,900+ companies reporting. For a more extensive background, refer to our blog post on CDP.

- TCFD – The guide to climate risk. The Taskforce on Climate-related Financial Disclosures (TCFD) provides guidance embraced by the CDP on how to explore and report risks and opportunities associated with the necessary transition to a net zero economy. While some companies release stand-alone TCFD reports or follow the recommendations in their sustainability or integrated reports, others are starting to use CDP to follow TCFD guidance.

- SASB – Financially material ESG items by industry. The Sustainability Accounting Standards Board (SASB) identifies ESG issues that are material to financial investors in 77 distinct industries. As we have blogged previously, researchers at Harvard Business School and elsewhere have confirmed that these industry-specific issues are indeed financially material to investors. Evidence shows that companies that are high-performers on sustainability issues identified by SASB as financially “material” outperform peer companies in value to shareholders, even when normalized for company size, age, and other influencing factors.

-

SBTi – Climate goals aligned with the Unites Nations (UN) Intergovernmental Panel on Climate Change (IPCC). The Science Based Targets Initiative (SBTi) – run by CDP, the UN Global Compact, WRI, WWF, and We Mean Business – is currently composed of 1,000 multinational companies committed to reducing greenhouse gas emissions in line with what the IPCC says is necessary to stave off the worst affects of climate breakdown. SBTi sets the methodology and approves corporate goals that are aligned with the “well-below 2 degrees,” 1.5 degrees, and soon Net Zero scenarios.

-

DJSI – The most venerable sustainability index. RobecoSAM’s (now part of S&P Global) Corporate Sustainability Assessment (CSA) is the questionnaire used to determine companies’ eligibility for inclusion in the Dow Jones Sustainability Index (DJSI). Companies scoring in the top 10% of their industry in the CSA that year are ranked on the DJSI.

- ISS, Sustainalytics, MSCI, etc. – The emerging raters. There are a handful of other research and rating firms respected by investors and often deriving revenue from both equity sellers and buyers. Several including MSCI and Sustainalytics, use artificial intelligence to scour public reports and websites data while, others, like ISS rely on a combination of AI and surveys to formulate scores.

We welcome the opportunity to discuss with current and potential Member-Clients how SR Inc can help your company design an ESG Strategy aligned with your company’s purpose and leveraging your companies unique strengths and positioning to drive a sustainable competitive advantage (find a case study here). While better managing and reporting ESG risks and opportunities and, specifically, identifying new revenue opportunities and driving improving margins as your company better aligns with the demands of your customers, employees, investors, suppliers and host communities’ lives.

Jim Boyle is CEO & Founder of Sustainability Roundtable, Inc. For more than a dozen years, Jim has led full-time teams of diverse experts to assist nearly 100 Fortune 500 and growth companies in their move to more sustainable high-performance. Specifically, SR Inc has helped world-leading corporations, real estate owners and federal agencies to set goals, drive progress, and report results in their move to greater Corporate Sustainability. Mr. Boyle led in the creation of SR Inc’s Renewable Energy Procurement Services (REPS), which advises and represents Fortune 500 and fast growth companies across the U.S. and internationally in the development of renewable energy strategies and the procurement of both on and off-site advanced energy solutions. Before founding SR Inc, Mr. Boyle co-led Trammell Crow Company Corporate Advisory Services in San Francisco and returned to his native Boston and Trammell Crow Company’s market leading team in Greater Boston where he received the Commercial Brokers Association’s Platinum Award for the highest level of commercial real estate transactions. Earlier, he advised companies on real estate and environmental matters as attorney at a large law firm based in Boston. Jim is a graduate of Middlebury College, where he co-captained the football team, and Boston College Law School. Early in his career, he served as a federal law clerk, an aide to John F. Kerry in the U. S. Senate, and on Vice President Al Gore’s campaign for President. Jim lives in Concord MA with his wife and kids a half mile across the street from Emerson’s house and museum on the route to Walden Pond.

Jim Boyle is CEO & Founder of Sustainability Roundtable, Inc. For more than a dozen years, Jim has led full-time teams of diverse experts to assist nearly 100 Fortune 500 and growth companies in their move to more sustainable high-performance. Specifically, SR Inc has helped world-leading corporations, real estate owners and federal agencies to set goals, drive progress, and report results in their move to greater Corporate Sustainability. Mr. Boyle led in the creation of SR Inc’s Renewable Energy Procurement Services (REPS), which advises and represents Fortune 500 and fast growth companies across the U.S. and internationally in the development of renewable energy strategies and the procurement of both on and off-site advanced energy solutions. Before founding SR Inc, Mr. Boyle co-led Trammell Crow Company Corporate Advisory Services in San Francisco and returned to his native Boston and Trammell Crow Company’s market leading team in Greater Boston where he received the Commercial Brokers Association’s Platinum Award for the highest level of commercial real estate transactions. Earlier, he advised companies on real estate and environmental matters as attorney at a large law firm based in Boston. Jim is a graduate of Middlebury College, where he co-captained the football team, and Boston College Law School. Early in his career, he served as a federal law clerk, an aide to John F. Kerry in the U. S. Senate, and on Vice President Al Gore’s campaign for President. Jim lives in Concord MA with his wife and kids a half mile across the street from Emerson’s house and museum on the route to Walden Pond.