This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

November 13, 2019

What is Material in Your Sustainability Strategy

An Introduction to Materiality and its Importance to Sustainability Strategy and Reporting

This is the third of several posts on the six components of a resonate and effective sustainability strategy for corporate operations that we have advised over 75 leading companies on for over a dozen years (see previous posts on Sustainability Vision and Governance, and be on the lookout for future posts related to Guidance, Implementation, and Results). In this post, we will examine the materiality assessment process that leading Member-Clients find critical for a successful Sustainability Strategy.

There are hundreds of topics that companies can choose from to develop their sustainability programs and reports. Materiality is the concept that allows companies to focus on the topics that are most important to them and their key stakeholders. In the most basic sense, material issues are those that could make a major difference to an organization’s performance. Materiality is a fundamental principle of financial reporting in the U.S. and recognizes that some information is important to the fair presentation of an entity’s financial condition and operational performance.

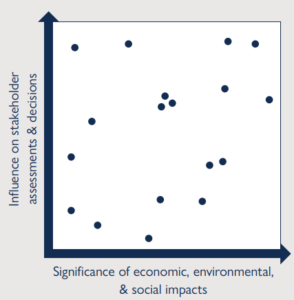

According to the Global Reporting Initiative (GRI) – an independent, international organization that helps businesses, governments, and other organizations understand and communicate the impact of business on critical sustainability issues – material issues in the sustainability sense are those that “reflect the organization’s significant economic, environmental and social impacts or substantively influence the assessments and decisions of stakeholders.”

Disclosure of material sustainability issues is important to investors, companies, regulators, and the public for the following reasons:

- The SEC already requires disclosure of material financial issues in key filings in use by investors.

- Institutional investors have a fiduciary duty that requires them to consider material issues.

- Companies have limited resources and must therefore focus on disclosing and managing the performance of material issues.

- The potential for negative social and environmental impacts of operations can present high costs to investors, companies, and society.

Most importantly, material information provides the basis for stakeholders and management to make sound judgments about the things that matter to them and take actions that influence the organization’s performance. As we first wrote about in our 2015 blog post, studies have shown that companies that outperform their peers on “material” non-financial sustainability considerations provide significantly more value to shareholders than similar companies in their industries who perform poorly on those items. According to Charles Gatchell of Nike, “the incorporation of stakeholder feedback is central to Nike’s approach to materiality. Nike’s Report Review Committee, who advises the company on what should be included in the CR Report, is a main mechanism for ensuring stakeholder viewpoints are considered when determining report content.”

GRI defines material issues along two axes: the issues that are most important to stakeholder assessments and decisions regarding the company, and the most significant economic, environmental, and social impacts of the company’s business.

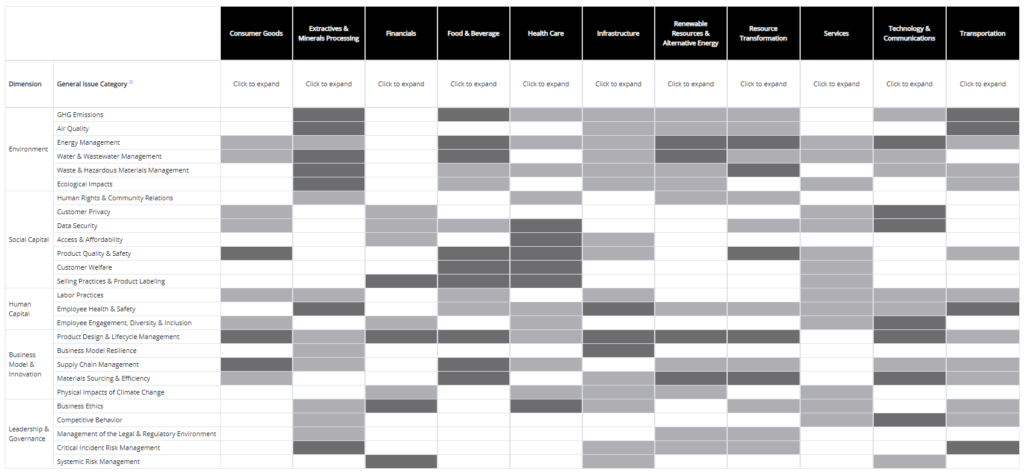

The Sustainability Accounting Standards Board (SASB) has also established standards for use by publicly-listed U.S. corporations in disclosing material sustainability issues for the benefit of investors and the public. In its Materiality Map, SASB has made impressive progress towards developing respected standards for what is “material” to corporate sustainability across 11 different sectors.

When performing a materiality assessment, it is important for companies to develop rigorous and practical approaches for determining the strategic significance of social and environmental issues. Some guidelines to keep in mind are:

- Base the process on the real practices of leading businesses.

- Put the business significance of sustainable development issues at the center of ESG thinking.

- Use this framework to inform strategy development as well as reporting.

- Make the program compatible with leading standards such as GRI and SASB.

The table below summarizes the achievements and challenges sustainability practitioners often face when developing materiality frameworks for their companies.

SR Inc regularly assists interested Member-Clients in performing materiality assessments. For example, SR Inc recently assisted Hakon Mattson, Director of Sustainability at Anthem, in conducting its first materiality assessment, which engaged members of senior leadership as well as dozens of employees – through a combination of surveys and focus groups – to determine what issues are most important to Anthem’s business and key stakeholders. This process helped to inform Anthem’s go-forward strategic priorities related to ESG as well as the content for its first CSR Report developed in accordance with GRI standards. Publishing a GRI Report helped to organize Anthem’s CSR program priorities internally while also conveying to Anthem’s stakeholders that the company takes ESG issues seriously.

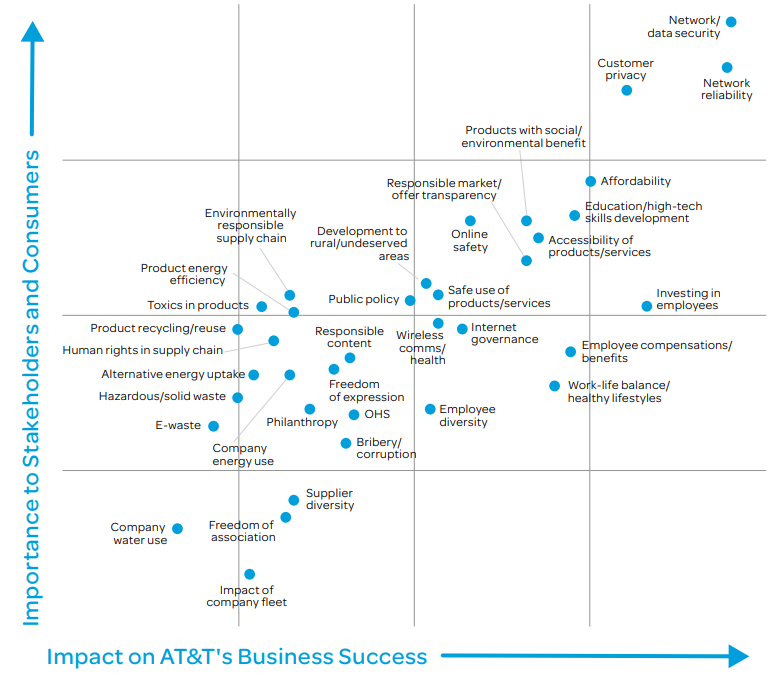

Below are two examples of materiality assessments conducted by Intel and AT&T, demonstrating industry best practice.

For more on materiality, view our Best Practices & Materiality resources in the SR Inc Digital Library, our 2018 blog post on Anthem, our 2015 blog post on Sustainability as a More Strategic Approach to management, and GRI and SASB’s webpages on the topic.