This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

March 19, 2020

How Nasdaq and Other Leading Companies are Promoting ESG Leadership

SR Inc’s 1st Quarter Symposium Includes Discussion on the Role of ESG Leadership to Public Policy Promotion

In response to the COVID-19 pandemic, SR Inc moved its first quarter Sustainable Business & Enterprise Roundtable (SBER) Executive Symposium, originally scheduled to be in Denver, to a webinar broadcasted from our headquarters in Cambridge last Friday, March 13th. Just like most Member-Client companies, SR Inc is doing all it can to take full advantage of remote working to practice “social distancing” and flatten this COVID-19 curve (see Figure 1). Essentially, the longer it takes for the coronavirus to spread through the population, the more time hospitals and health workers have to prepare, and the better off the world will be. Without taking significant protective measures like social distancing, wherein people avoid crowds of 10 people or more, avoid discretionary travel, keep distances of six feet away from other people, and continually wash their hands and practice good hygiene, we could overwhelm the healthcare system and see many more critical and severe cases and deaths (the red curve) than we would with these protective measures (the blue curve). The U.S. has a total of 160,000 ventilators and under a million hospital beds, so it is vitally important that we not overwhelm hospitals all at once. Please be on the lookout for an email about an upcoming virtual meeting for Member-Clients about the global workplace response to COVID-19 on March 26th.

The first 45 minutes of our discussions centered on ESG leadership and policy leadership, with a presentation on management research and best practices from SR Inc CEO Jim Boyle and updates from Evan Harvey, Global Head of Sustainability at Nasdaq.

Jim Boyle started off by presenting on best practices gleaned from SR Inc Member-Clients on how leaders are leveraging public commitments to engage the C-Suite and align with the most sought-after customers, talent, investors, and host communities. The importance of ESG performance for public companies has become increasingly evident over the past several months. Late last year, Bank of America Merrill Lynch’s Global Wealth ESG Primer detailed the Top 10 Reasons companies should care about ESG. ESG high-performing companies outperformed their peers over the last 5 years by more than 3% annually in shareholder value and had a lower cost of capital. The Primer also described that 90+% of the firms that went bankrupt in the last five years were ESG low performers and that ESG Management was the best indicator of risk – better even than debt.

Larry Fink, the CEO of Blackrock, the world’s largest private investment firm with more than $7 trillion assets under management, agrees. In the first weeks of 2020, he sent his annual letter to the 2,700+ CEOs whose companies Blackrock invests in, saying: “every government, company and shareholder must confront climate change.” Fink then got more specific than in years past, warning: “every company, investor and government must prepare for a significant re-allocation of capital.” Fink also got more prescriptive, requesting that CEOs: (a) “publish a disclosure in line with the industry specific Sustainability Accounting Standards Board (SASB) guidelines by year end;” and (b) “disclose climate-related risk in line with the Taskforce on Climate-related Financial Disclosures (TCFD).”

Another recent sign of this transition to ESG high performance was a full-page ad in The New York Times by 11 leading environmental NGOs calling on businesses to advocate for policies at all levels of government consistent with what climate science is telling us we need to do to transition away from a fossil fuel economy. Specifically, they ask for businesses to (1) advocate for policies consistent with Net Zero Emissions, (2) align their trade associations’ advocacy with science-based climate policy, and (3) fund advocacy that advances responsible climate policies.

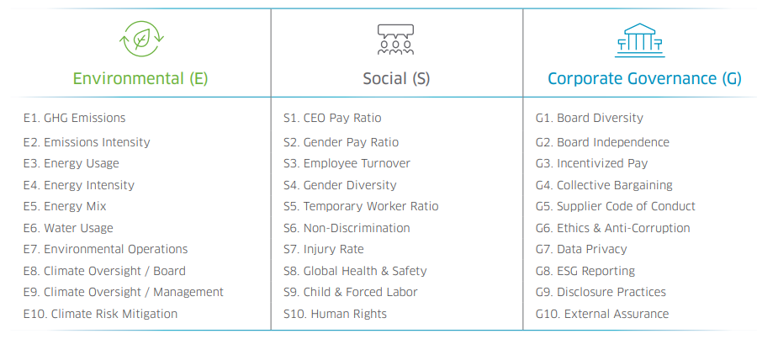

We then turned to Evan Harvey, Global Head of Sustainability at SR Inc Member-Client Nasdaq, which is one of the world’s leading stock exchanges. Evan has an internal and external facing role to help disseminate best practices and bring together the world’s leading stock exchanges around ESG high-performance. Nasdaq has demonstrated this move to operationalize high ESG performance both in its own operations and in how it seeks to help listed companies. In one important effort, Evan took the initiative to produce and integrate what SR Inc sees as best practice guidance in the ESG Reporting Guidance 2.0 released last year. Therein, Nasdaq was careful to note that the materiality of ESG items is critical and must be independently determined by each operating company to advance its particular strategy. Moreover, Nasdaq made clear the guidance provided was not required by mandate or practice to be effectively listed on its exchange. Nonetheless, working with companies leading in ESG management, Nasdaq iterated this Guidebook to define 10 items within each ESG dimension that most companies will likely want to report on to help drive recognition of their high ESG performance, shown in Figure 5. This reporting guidance has been taken up by 40 stock markets around the word.

Evan has also both witnessed and influenced the progress made with laws proposed on ESG disclosure. In July, the U.S. House of Representatives held its first hearing on mandatory ESG disclosures for public companies. After the hearing, Evan commented, “Nasdaq has long advocated better understanding of ESG dynamics in the market, more equitable access to decision-making data and better metrics themselves. Any emerging standard must reckon with the disclosure burden that companies already bear and strike a balance between the burden and benefit of transparency.” This measure passed out of committee and is likely to make it to the House floor at some point in the near future and is almost certain to pass if the White House and Senate flip in November. There has also been meaningful progress on mandatory disclosures at the state level in Illinois, California, Massachusetts, New York, New Jersey, Michigan, and others.

To finish off his presentation, Evan spoke about the evolution of Nasdaq’s digital ESG Reporting Platform, now called Nasdaq OneReport. The platform applies innovative technology and resources to create unique information and analytics to influence investing decision-making by:

- Orchestrating information capture, response management, and disclosure for GRI, CDP, DJSI, MSCI, Sustainalytics, and others from a single platform

- Harmonizing and navigating the many frameworks, ratings, assessments, indices, standards, metrics, and public reporting demands

- Delivering unified and tailored ESG data to raters, investors, and other stakeholders

The platform is now voluntarily used by 400 listed companies and clients to help collect ESG data and easily report out to multiple channels.

As Manager of Research & Consulting at Sustainability Roundtable, Inc., Jeff Meltzer provides outsourced program assistance to clients on a one-to-one basis, helping real estate, operations, CSR, and sustainability executives set goals, drive progress, and report the results of their sustainability programs. Jeff holds a Master of Environmental Management from Duke University’s Nicholas School of the Environment and a B.A. in Environmental Policy from Colby College. He has relevant work experience with the Procurement and Property Services team at Citizens Bank as an EDF Climate Corps Fellow, with the EHS and Sustainability team at L’Oréal, and with the EPA Green Power Partnership as an Environmental Analyst at Eastern Research Group. He has client project experience with Biogen, helping the company develop a Scope 3 supplier engagement strategy to achieve its Science-Based Target. Jeff is also an active participant in sustainability groups, is an accredited LEED Green Associate, is trained in the GRI Standards and GHG Protocol, was the Co-President of the Duke’s Net Impact club, and is an active member of the Net Impact Boston leadership team.

As Manager of Research & Consulting at Sustainability Roundtable, Inc., Jeff Meltzer provides outsourced program assistance to clients on a one-to-one basis, helping real estate, operations, CSR, and sustainability executives set goals, drive progress, and report the results of their sustainability programs. Jeff holds a Master of Environmental Management from Duke University’s Nicholas School of the Environment and a B.A. in Environmental Policy from Colby College. He has relevant work experience with the Procurement and Property Services team at Citizens Bank as an EDF Climate Corps Fellow, with the EHS and Sustainability team at L’Oréal, and with the EPA Green Power Partnership as an Environmental Analyst at Eastern Research Group. He has client project experience with Biogen, helping the company develop a Scope 3 supplier engagement strategy to achieve its Science-Based Target. Jeff is also an active participant in sustainability groups, is an accredited LEED Green Associate, is trained in the GRI Standards and GHG Protocol, was the Co-President of the Duke’s Net Impact club, and is an active member of the Net Impact Boston leadership team.