This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

September 28, 2015

SR Inc Deepens Exploration of IoE & Renewable Energy During Q3 SBER Symposium at Bloomberg HQ in NYC

SR Inc hosted a Sustainable Business & Enterprise Roundtable (SBER) Q3 Executive Symposium in NYC entitled “Portfolio Managers Meet the IoE & Renewable Energy Revolutions” on September 17th at Bloomberg’s Headquarters in New York, NY.

The discussion began with a presentation by Lenora Suki, Head of Sustainable Finance Product Strategy for Bloomberg LP, who shared the latest on Bloomberg’s Environmental Social & Governance (ESG) Reporting Initiatives and the Sustainability Accounting Standards Board (SASB).

Lenora noted:

- The Bloomberg Terminal is a reporting platform that provides about 300 fields worth of ESG-related information for approximately 11,000 companies

- The goal of this platform is to provide financial institutions and other stakeholders with objective, analytical ESG data

- Over 20,000 unique users accessed ESG data in July 2015, up from approximately 6,000 in July 2012.

Lenora also discussed the Sustainability Accounting Standards Board (SASB), which is developing and disseminating sustainability accounting standards to help public corporations disclose material, decision-useful information to investors. One of SASB’s most important contributions will be systematically defining what constitutes a material ESG item in about 80 distinct industries. To read SR Inc’s blogpost on SASB, click here.

The remainder of the discussion focused on SR Inc’s SBER Shared Research Focus for 2015 – “Net Zero Impact Portfolio-wide by 2030” – and more specifically on SBER’s two 2015 chartered projects: “Portfolio Manager Meets the Internet of Everything (IoE)” and “Portfolio Manager Meets the Renewable Energy Revolution”. SR Inc CEO Jim Boyle noted that the goal of Net Zero Impact Portfolios by 2030 is becoming perceived as less audacious – just in the past year – as the promise of both IoE and Renewable Energy is becoming better understood in Corporate Real Estate (CRE).

Portfolio Manager, Meet the IOE in CRE:

The following are key takeaways from the presentation provided by SR Inc on the IoE in CRE, highlighting general findings from multiple Member-Clients developed in preparation for this meeting.

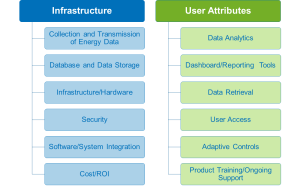

Based on responses to SR Inc’s SBER Request for Information (RFI) on Portfolio-wide Intelligent Building Integration Systems, Member-Clients have expressed an interest in low-cost, cloud-based, portfolio-wide data capture, management, and analysis solutions like Lucid’s BuildingOS. Consequently, SR Inc is speaking with multiple SBER Member-clients about their interest in issuing relevant, detailed, RFPs.

- Senior management and employee interest in Corporate Sustainability creates an opportunity for Portfolio Managers to better organize and drive portfolio-wide digitalization

- Next generation cloud-based management systems, sensors, sub-meters, analytics, and dashboards offer increased functionality, lower cost and easier integration across portfolios

- In the acquisition and deployment of IoE solutions, Portfolio Managers’ challenges related to “people and process” are more important than technical capabilities or direct cost of systems

- Successful data system integrations align KPI/metrics and reporting processes across functional areas and geographies

- IoE applications are emerging for the knowledge workplace environment which offer dramatic gains in quantifying health and knowledge worker productivity gains

- Security remains a threshold issue, especially for Wi-Fi-enabled, portfolio-wide, cloud-based solutions, but it is manageable through existing systems

- Leading solutions provide controlled, role-based access to the integrated portfolio-wide information management system

Portfolio Manager, Meet the Renewable Energy Revolution

The following are key takeaways from the presentation provided by SR Inc on Renewable Energy in CRE, highlighting general findings from multiple Member-Clients developed in preparation for this meeting.

Please note that SR Inc has issued an RFI on offsite renewable energy, and several Member-Clients have expressed interest in respondents’ solutions for integrating PV, storage and Demand Response to enhance the business case for solar, as SolarCity’s DemandLogic claims to do. Consequently, SR Inc is speaking with multiple Member-clients about their interest in detailed, relevant RFPs.

- The cost of installed solar in the U.S. has dropped 73% since 2006

- The 30% Federal Solar Tax Credit’s reduction to 10% after year end 2016 is looming large

- Renewables are emerging as a shaping opportunity for corporate sustainability

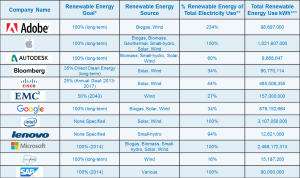

- Sourcing 100% renewable energy is becoming a regular public ambition of top global companies in the IT sector

- In 2014 and 2015, direct renewable energy moved from being done by a minority of SBER Member-Clients to a decisive majority

- Direct renewable energy procurement is replacing RECs in the effort to achieve corporate renewable energy goals

- PPAs for offsite grid-proximate renewable energy have emerged as a preferred solution

- Leading providers of offsite PPAs are increasingly willing to do deals as short as 10 years

- Solar for leased space is becoming more viable due to improved economics and perceived commercial value of renewables among landlords

- Integrated PV, storage solutions, and intelligent energy management systems may enable demand response and improved project economics

- Corporate buyers are beginning to examine aggregated buying

Thank you to all who were able to participate, and especially to our host, Bloomberg LP and to our primary presenters, Lenora Suki, Head of Sustainable Finance Product Strategy at Bloomberg LP, Michael Barry, Sustainability Manager at Bloomberg LP, and Hakon Mattson, CRE Facilities Director at Anthem.

SBER Member-Clients can request the complete deck of Slides and Discussion Summary from the Symposium as well as relevant SR Inc Executive Guidance and Tools and/or a presentation from their SBER Advisor. Moreover, Member-Clients can access relevant material in SR Inc’s Digital Library here.

Member-Clients will next meet in Cambridge, MA for an Executive Lunch at SR Inc’s HQ Board Room October 8th and then for a Q4 Executive Symposium in the Bay Area December 3rd to share the results of relevant 2015 SBER Management Best Practice case studies and RFI/RFP responses related IoE and Renewable Energy in CRE.