This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

July 23, 2013

Sustainability Imperative Recognized by PwC Asset Management

Yesterday, PwC released their July 2013 “US Real Estate Insights,” a collection of articles on market trends, regulations and legislative activity relating to the real estate industry. Within this, Don Reed and Cope Willis’ article “Key Sustainability Trends Driving Business Value in the Real Estate Sector” reflects the recent experiences of SBER Member-Clients, specifically real estate asset managers, investor-advisors, and landlord-owners.

The article elucidates various key drivers responsible for sustainability trends within the commercial real estate market.

- Institutional investors increasingly seek the ESG performance of their real estate investment portfolios. Additionally, more and more researchers and ratings groups such as TruCost and Sustainalytics are looking to rank funds on ESG performance. In response to this, the FTSE Group, the National Association of Real Estate Investment Trusts (NAREIT) and the U.S. Green Building Council (USGBC) have recently collaborated to create a suite of green property index funds, which will rate funds on a value scale according to how many assets have obtained LEED certification or Energy Star labeling.

- Shareholders of public real estate funds increasingly seek the sustainability reporting, GHG emissions, and ESG performance of their funds. U.S. and international stock exchanges recently discussed potential sustainability disclosure requirements with various institutional investors. These institutional investors will present recommendations at the World Federation of Exchanges in October 2014.

- Real estate investment funds voluntarily report ESG and sustainability performance via mechanisms such as the Global Real Estate Sustainability Benchmark (GRESB) and the Carbon Disclosure Project (CDP) due to this expanding interest. A total of 443 property companies and funds participated in the 2012 GRESB survey.

- Asset managers continue to see that efficiency improvements (energy, water) and green certification (LEED) within their portfolios result in cost savings and tenant satisfaction.

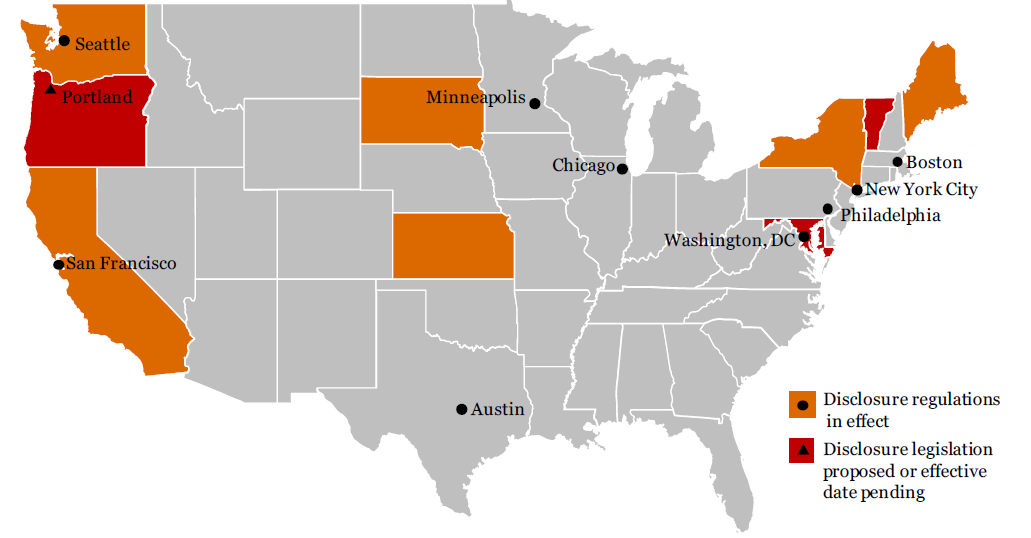

- State and municipal governments are enacting laws which require property owners to report their building’s energy performance, posing both compliance mandates for asset managers and potential performance risks for the assets themselves. The below figure portrays a geographic perspective of where these laws are currently enacted or proposed.

Sources: PwC, Ceres, Buildingrating.org

Reed and Willis list various recommendations for asset managers to act on these current market trends by strategizing ways to:

- Communicate the ESG performance of funds to investors and analysts

- Address the increasing state and local energy disclosure requirements

- Understand what tenants want in terms of sustainability, and how those desires should inform future investments in renovations and new construction

- Become aware of, and use, all available tax credits and incentives so that investments in efficiency and renewables are as cost-effective as possible

SR Inc is pleased to assist world-leading funds and owners as they improve their performance and reporting portfolio-wide, including the category leader in large diversified funds, Bentall Kennedy, and Clarion Partners, which acquired Gables Residential, the GRESB category leader in multi-family.

SR Inc SBER Member-clients are encouraged to contact their SBER Advisor for any related assistance they are interested in, and SBER Member-clients are welcome to access the handful of the dozens of related pieces of SR Inc original Management Best Practice Research, Executive Guidance & Tools listed below:

Advancing Portfolio-wide Sustainability Strategy

Benchmarking Real Estate Portfolio Sustainability

Taking The Path to Higher Performance: Energy Management using Advanced Analytics and Controls

Regional Cost Variation of Eleven Top Energy Conservation Measures