This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

January 9, 2019

10 Reasons for Climate Hope in 2019

Broadly defined, business is likely the primary activity of human beings and 2018 provided signs that business is waking up to the challenge and opportunity of anthropogenic climate change. Publicly traded global corporations, in particular, are increasingly deliberate in their efforts to align with the climate concerns of their most sought-after customers, talent and investors. As they sell, hire and invest all over a world where the concern of the most informed about climate change only increases year over year.

In 2018, the urgency of the existential challenge of human-caused climate change came into undeniable view. Reports from U.S. federal agencies and the U.N. in Q4 of 2018 are being read by, and reported to, the most informed – who overlap substantially with the most sought after customers, talent and investors. These reports make it clear that when it comes to climate change, our collective trend lines are damning and time is short.

Many of those responsible for managing corporate Environmental, Social and Governance (ESG) programs, noted a change in tone in how leading climate scientists and activists spoke publicly about the challenge of climate change. The fact that three years after the U.N.’s Paris Climate Accord among more than 190 nations (which was a generation in development), the Trump Administration is committed to removing the world’s largest economy from it, has taken on an even more ominous meaning in the light of these U.S. and U.N. reports indicating that climate change is happening even faster than long feared.

The impact focused Fourth National Climate Assessment, Volume II represents the work of 13 U.S. federal agencies including the CIA, Department of Defense as well as the EPA and was released in November. It reported that without unprecedented, far reaching change, we can expect “substantial damages on the U.S. economy, human health and the environment. . . [with] annual losses in some sectors estimated to grow to hundreds of billions of dollars by the end of the century.”1

An even more challenging report was issued in October by the U.N.’s Intergovernmental Panel on Climate Change (IPCC) which represents the work of more than 1,000 climate scientists working in more than 40 nations. This IPCC report found that dramatic, deliberate, change was required before 2030 to avoid irreversible, self-accelerating, collapse of ecologies globally, including a loss of all of the world’s coral reefs, floods and famine as well as an unprecedented loss of human life, especially among the world’s poor.

In the face of the Trump Administration’s recalcitrance about responsible action, these two reports have encouraged climate scientists, activists and some politicians to speak more boldly about the need for thoroughgoing, urgent, change. And to increase the effort of sub-national governments, cities, businesses and local communities in the U.S. to respond to the challenge of climate change. Although organizationally this cross sector public/private grassroots and corporate leader movement is best represented by the “We Are Still In” campaign (referencing to the Paris Accord), specific development trends in capital markets, standard setting, reporting, renewable energy, municipal and state commitments and the dawning transformation of the utility industry all provide hope for needed and inflecting progress in 2019. Moreover the outstanding Project Drawdown which SR Inc is proud to financially support has charted an invaluable path showing how the world’s leading 100 solutions could accelerate our move towards the necessary Drawdown of Greenhouse Gases (GHG) from our atmosphere. (See: www.drawdown.org)

Below find a list of ten developments Sustainability Roundtable Inc’s team finds especially promising:

#10. 1 in 4 Dollars of Managed Capital is Now Subject to ESG Considerations

Over the last two years, in particular, rigorous quantitative research increasingly demonstrated the positive correlation between high-performance on Environmental, Social and Governance (ESG) items and increased shareholder value.2. Consequently, it is not surprising that the percent of Assets Under Management (AUM) subject to ESG screens has skyrocketed.3 As SR Inc has observed, ESG items have to be “material” to have a predictable impact shareholder value. So not all ESG considerations (e.g. negative filters removing tobacco or pornography) indicate a likelihood of higher share performance. Nonetheless, the fact markets are evolving beyond reductionist, backward-looking, cash-only accounting standards to be able to consider non-cash items helps. As His Royal Highness, Prince Charles (an international leader in integrated financial and ESG reporting) has observed, 21 century capitalism requires a more comprehensive view of corporate performance than reductionist 18th century accounting practices allow.4 Underscoring the need to a broader view of the indicators of likely value creation, is the well noted, global, move to a service based economy wherein a substantial majority of shareholder value in global corporations is now attributable to intangible “Good Will.”5 Consequently, the regularly increasing data transparency coupled with increased sophistication about what constitutes “material” ESG issues is creating the promise of more evolved capital markets that more sensitive to which companies are more likely to be able to increase shareholder value in a world of accelerating environmental and social related change. 2018 began to see this once esoteric perspective become more commonly accepted “ESG performance” became an area of interest for analysts without prior interest in sustainability issues or sustainability oriented funds.

#9. Rigorous and Respected Standards Increasingly Defined Sustainable High Performance for Investors

The Sustainability Accounting Standards Board (SASB) was founded by a former SR Inc Member Executive, Jean Rogers and is conceptually modeled on the Financial Accounting Standards Board. In 2018, SASB completed a multi-year, multi-stakeholder process to define what Environmental, Social and Governance (ESG) issues are financially material to investors across 77 distinct industries. Since SASB’s Board of Advisor Member, Professor George Serafeim at Harvard Business School has done impressive work demonstrating the financial materiality of SASB indicators, it is not surprising that SR Inc Member-clients regularly seek to use SASB identified items in their own, internal, Materiality Analysis.6 Similarly, the Global Real Estate Sustainability Benchmark (GRESB) continued to grow to 903 participating companies, Real Estate Investment Trusts, Funds, and Developers covering some 79,000 assets in 64 countries. As GRESB increasingly does for real estate portfolios what the U.S. Green Building Council’s LEED Building Rating has done for individual buildings, institutional real estate is becoming an asset class wherein sustainability leaders can be rewarded for their high-performance at a fund level as rigorous quantitative analysis have demonstrated individual buildings assets have benefited from becoming more sustainable.7

#8. 78% of the S&P 500 Joined In Increasingly Ubiquitous Sustainability Reports

In 2018, Sustainability Reporting among the largest, publicly traded, corporations continued to grow towards being ubiquitous, as 78% of the S&P 500 offered some form of Sustainability Report. In some respects, the importance of that fact is match by the fact that the number of S&P 500 firms providing reports that integrated financial and ESG performance data doubled. Even though the number it doubled to was only 14. On a much broader level, the number of companies of all sizes submitting Green House Gas emission data through climate change responses to CDP in 2018 rose by 36% from 2017, to total 3,296 companies. Moreover, CDP’s analysis of high-impact companies found that the number of companies reporting multi-year emissions targets and developing long-term sustainability roadmaps (to 2030 and beyond) continues to rise year over year.

#7. 159 Global Corporations Committed to 100% Renewable Energy

In 2018, the remarkably successful RE100 grew to 159 firms committing to 100% renewable energy. Although many of these firms, especially foreign-headquartered consumer product firms, continued to use environmental attribute certifications that do not, necessarily, represent new renewable energy. Many RE100 firms are, however, moving from these “Unbundled” Renewable Energy Certificates (RECS)” to more credible “Bundled RECs” that are bundled into the same contract that finances the new renewable energy plant that creates the renewably powered Mega Watt hour that the “Bundled REC” represents. In this way, “Bundled RECs” are increasingly providing enterprises with a more credible claim to causing new renewable energy to be created to support their claims of off-setting their continued purchase of conventionally generated electricity.8 And the example of so many large and sophisticated corporate energy users move to Net Zero GHG emissions has made an undeniable and powerful impression on their customers, competitors, supply chains and public policy-makers. An increasing number of whom are following these corporate leaders in their commitment to 100% renewable energy.

#6. 100+ U.S. Cities Committed to 100% Renewable Energy

Most SR Inc Member-clients have a presence in the largest U.S. cities. And by year-end 2018, most all those cities have committed to 100% renewable or at least “clean” energy. On December 5th, Cincinnati, Ohio became the 100th U.S. city to commit to 100% renewable energy when its City Council voted to commit to community-wide 100% goal to be achieved by 2035.9 This does not even account for the many hundreds of smaller communities like my own hometown of Concord, Massachusetts which voted overwhelmingly in Town Meeting to commit to 100% renewable energy by 2030 and is one of the 40 towns in Massachusetts that operates its own municipal utility. And as seen below, these votes by cities and towns are impacting the planning of larger utilities who depend on towns and cities as critically important customers. As the year ended, the D.C. Council voted unanimously to move their “State” (in their description) to leadership and through a commitment to 100% renewable energy by 2032. So whether it is celebrated inside their halls and Hearing Rooms or not, the White House and most all Agency Buildings as well as all Congressional Buildings will be powered by 100% renewable energy.

#5. Two of America’s Largest States & Hawaii Commit to 100% Clean Energy

Beyond federal tax credits that are declining and not expected to be renewed, State law is currently at least as important as federal law in America’s transition to a low carbon electricity. And November 6th, 2018 was a landmark night for renewable energy as Governors were elected in ten (10) U.S. states promising ambitious action on renewable energy. Three promised 100% clean energy before 2045. A report by Wood McKenzie found examining five new, larger state, governors with supportive, Democratic Party dominated legislature found that if all five succeeded in establishing at least 50% renewable portfolio standards by 2030, that could cause an incremental 34 GW of renewables by 2030. But even more important, two of the largest and most influential states in the U.S. – California and New York – committed in 2018 to following Hawaii’s leadership in 2017 and committed to 100% clean energy (by 2045 in California and by 2040 in New York state). New York has now become one of 14 U.S. states with a Governor’s office, House and Senate controlled by Democrats (the GOP now controls both the governor’s office and legislature in 21 states) including newly all Democratic Colorado and Illinois. Which are both expected to act on their new governors’ promises to move quickly to follow California’s, Hawaii’s and New York lead and commit to 100% carbon free electricity.

#4. The Largest Investment Bank Says Renewables Are the Cheapest Electricity Source – Before Subsidies

Lazard is the world’s largest advisory-focused investment bank and its annual report on the Levelized Cost of Energy (LCOE), which examines how much it costs to build energy plants before subsidies, has become an important marker for those tracking the revolution in renewable energy technologies. In late 2017, Lazard’s 11th annual LCOE Report shared that utility scale wind and sometimes even utility scale solar was – even before subsidies – increasingly less expensive than coal plants. In late 2018, Lazard’s 12th Annual LCOE Report showed that utility scale wind and solar had both continued to decline in cost and now were often less expensive than both coal and natural gas – before subsidies. Moreover, Lazard’s 4th annual report on Energy Storage also revealed that the cost of batteries and integrated solar and storage and wind and storage solutions continued to plummet. And as the Financial Times noted, that means it can now be less expensive to develop new renewable and storage systems than to continue to operate existing, fully depreciated, coal and even natural gas plants.

#3. Multiple U.S. Utilities Officially Plan to go 100% Renewables & Batteries – For Reason of Costs

Multiple U.S. utilities are beginning to send deep sonic shockwaves through the global energy industry through their Integrated Resource Plans where, at the end of 2018, they began to reflect that utility scale Wind and Solar are less expensive technologies for generating electricity than burning either coal or methane (i.e. “Natural Gas”). Moreover, in a small handful of markets in California, Colorado, Hawaii and Indiana, utilities are beginning to reflect the even more revolutionary fact that when combined with large scale energy storage, Wind and Solar can provide dispatchable power and even prompt the early retirement of fossil fuel plants. Platte River Power Authority is one example where has proposed to replacing its entire portfolio of coal plants with 100% large scale Wind, Solar and Batteries by 2030 – for reasons of costs. Platte River made this announcement immediately after its competitor Xcel Energy announced its commitment to 80% clean energy by 2030 and 100% by 2050 across it boarder multi-state territory. Which is consistent with the Northern Indiana Power Authority who also announced it is moving to 100% clean energy by 2045 for reasons of costs – specifically because it would save ratepayers some 4 billion dollars. Perhaps most telling of all: PG&E announced contracts for two of the world’s larger batteries (Vistra’s 300MW/1,200MWh and Tesla’s 182.5 MW/73MWh) to replace three California Calpine Methane (aka Natural Gas) plants – early.10

#2. The World’s Most Sophisticated Companies Cause 16+ GW of New Renewables in the US

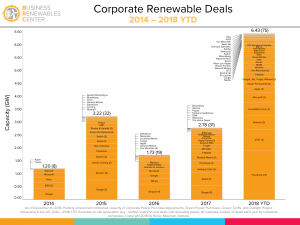

Beyond goal setting and even official planning, scores of the world’s largest and most sophisticated companies are leading by example by signing large scale, off-site Power Purchase Agreements causing renewable energy to be built in the U.S. at rates that keep overrunning even the most optimistic projections. SR Inc is proud to have co-sponsored the Rocky Mountain Institute’s Business Renewables Center. The “BRC” has helped scores of corporate buyers, developers and experts collaborate to facilitate large scale off-site Power Purchase Agreements. The BRC calculates that 2018 was a breakthrough year that saw increasingly more regular sized corporates making commitments to large scale off-site PPAs that in 2018 alone was responsible for causing more than 6.4 GWs of new renewable energy to be developed in the U.S. and that has caused – in just the last five years – more than 16 GWs of new renewable energy to be developed in the U.S. Although a handful of extremely large corporations like Apple, Alphabet and Microsoft drove the early development of this Virtual Power Purchase Agreement (VPPA) market 2012-2016, in 2018 more regular sized corporations began to enter the market through Aggregated VPPAs that pooled “Off-takers” demand to enable them to access the economies of scale that so advantage utility scale renewables.

#1. Aggregated VPPAs (aka VPPA 2.0) Provide a Profitable Path to Net Zero Emissions for all High Credit Organizations

Corporations, municipalities and universities not as large as Apple, Amazon and Alphabet demonstrated in 2018 that they can join together in Aggregated VPPAs to procure more credible Bundled RECs with unequivocally clear claims to representing additional renewable energy. In this way these organizations have off-set the GHG emissions associated with their electricity use even in their leased space across both regulated and deregulated electricity markets throughout the U.S. This has provided organizations as diverse at MIT, the Boston Medical Center (in 2016), Boston University, the District of Columbia as well as more regular sized corporations like Akamai Technologies, Etsy, Swiss RE and Intuit a way to chart a no necessary first capital path to 100% renewables and Net Zero GHG emissions (see Corporate Renewable Energy Breakthrough: VPPA 2.0 Benefits & Risks). And with fixed 12 year VPPA Prices now regularly being offered at rates 25+% below current grid prices (which are viewed as historically low) and even below the prices being achieved by competitive currently operating Wind and Solar farms, it is not surprising that buyers (i.e. “Off-takers”) willing to commit to 12 year VPPAs for Wind and 15 year VPPAs for Solar now regularly model Month One and Year One positive cash flows and seven figure NPVs over term, while obtaining all the more credible Bundled RECS they need for ambitious sustainability strategies. In this way, Aggregated VPPAs tailored for risk adverse procurement managers (as opposed to huge company energy investors) who are primarily interested in more credible “Bundled RECs” that they can use to off-set their enterprises emissions nationally – have become no less than Renewable Energy for Every Enterprise and created the opportunity for all interested high credit enterprises to participate in the growing cost advantage of utility scale renewable energy and chart a lower risk, financial advantageous, path to 100% renewable energy and Net Zero GHG emissions.

1 Fourth National Climate Assessment, Volume 2: Summary Findings.

2 Khan, Mozaffar, George Serafeim, and Aaron Yoon. “Corporate Sustainability: First Evidence on Materiality.”Accounting Review 91, no. 6 (November 2016).

3 Osborn, D. 2018. ESG Performance Now Mainstream Driver for Shareholder Value.

4 Accounting for Sustainability

5 OceanTomo. 2017. Intangible Asset Market Value Study.

6 Khan, Mozaffar, George Serafeim, and Aaron Yoon. “Corporate Sustainability: First Evidence on Materiality.”Accounting Review 91, no. 6 (November 2016).

7 Gray-Donald, J. 2016. “The Data Is In: Green Buildings Financially Outperform Rivals.”

8 Landry, E. 2017 “Not All RECs Are Created Equal.”

9 Doherty, B. 2017. “Global, National, State & Municipal 100% Renewable Energy Commitments.”

10 Spector, J. 2019. “PG&E’s Record-Breaking Battery Proposal Wins Approval From Regulators.” Greentech Media.

Jim Boyle is CEO & Founder of Sustainability Roundtable, Inc. For more than ten years, Jim has led full-time teams of diverse experts to assist nearly 100 Fortune 1000 companies on a multi-year basis in their move to more sustainable high-performance. Specifically, SR Inc has helped world-leading corporations, real estate owners and federal agencies to Set Goals, Drive Progress & Report Results in greater Corporate Sustainability. Jim has led in developing SR Inc’s confidential, industry specific, annual Management Assessment and Recommendation process for more sustainable global operations and energy that is compatible with major standards. Further, he has directed the development of hundreds of pieces of SR Inc original, case based Management Best Practices Research and Executive Guidance & Tools available in SR Inc.’s digital library. Mr. Boyle led in the creation of SR Inc’s Renewable Energy Procurement Services (REPS), which advises and represent Fortune 100 Member-clients and fast growth technology companies across the U.S. and internationally in the development of Renewable Energy Strategies and the procurement of both on and off-site advanced energy solutions. Before founding SR Inc, Mr. Boyle advised fast growth technology firms, institutional investors and private equity firms as an adviser on real estate strategy and transactions, and before that, as a large law firm attorney assisting corporate and investment clients on complex real estate and environmental compliance-related issues. He co-led Trammell Crow Company Corporate Advisory Services in San Francisco and returned to his native Boston and Trammell Crow Company’s market leading team in Greater Boston where he received the Commercial Brokers Association’s Platinum Award for the highest level of commercial real estate transactions. While at Trammell Crow Company, he incorporated and was the principal co-founder of the Alliance for Business Leadership, a MA based non-profit for CEO, investors and business leaders who share a commitment to socially responsible business practices and public policy. Jim is a graduate of Middlebury College where he co-captained the football team and Boston College Law School, who early in his career served as a federal law clerk, an aide to John F. Kerry in the U. S. Senate and on Vice President Al Gore’s campaign for President. He lives in Concord, MA with his wife and two children and writes and speaks regularly on best practices in more sustainable business. See e.g., Could LEED for Existing Buildings Transform the Building Industry, Urban Land and An Unprecedented Opportunity & Moment for CRE, CoreNet Global, LEADER.

Jim Boyle is CEO & Founder of Sustainability Roundtable, Inc. For more than ten years, Jim has led full-time teams of diverse experts to assist nearly 100 Fortune 1000 companies on a multi-year basis in their move to more sustainable high-performance. Specifically, SR Inc has helped world-leading corporations, real estate owners and federal agencies to Set Goals, Drive Progress & Report Results in greater Corporate Sustainability. Jim has led in developing SR Inc’s confidential, industry specific, annual Management Assessment and Recommendation process for more sustainable global operations and energy that is compatible with major standards. Further, he has directed the development of hundreds of pieces of SR Inc original, case based Management Best Practices Research and Executive Guidance & Tools available in SR Inc.’s digital library. Mr. Boyle led in the creation of SR Inc’s Renewable Energy Procurement Services (REPS), which advises and represent Fortune 100 Member-clients and fast growth technology companies across the U.S. and internationally in the development of Renewable Energy Strategies and the procurement of both on and off-site advanced energy solutions. Before founding SR Inc, Mr. Boyle advised fast growth technology firms, institutional investors and private equity firms as an adviser on real estate strategy and transactions, and before that, as a large law firm attorney assisting corporate and investment clients on complex real estate and environmental compliance-related issues. He co-led Trammell Crow Company Corporate Advisory Services in San Francisco and returned to his native Boston and Trammell Crow Company’s market leading team in Greater Boston where he received the Commercial Brokers Association’s Platinum Award for the highest level of commercial real estate transactions. While at Trammell Crow Company, he incorporated and was the principal co-founder of the Alliance for Business Leadership, a MA based non-profit for CEO, investors and business leaders who share a commitment to socially responsible business practices and public policy. Jim is a graduate of Middlebury College where he co-captained the football team and Boston College Law School, who early in his career served as a federal law clerk, an aide to John F. Kerry in the U. S. Senate and on Vice President Al Gore’s campaign for President. He lives in Concord, MA with his wife and two children and writes and speaks regularly on best practices in more sustainable business. See e.g., Could LEED for Existing Buildings Transform the Building Industry, Urban Land and An Unprecedented Opportunity & Moment for CRE, CoreNet Global, LEADER.