This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

July 15, 2022

Net Zero Consortium for Buyers U.S. VPPA Opportunity Index: 2022 Q2

In the second quarter of 2022, an unprecedented number of increasingly diverse corporate off-takers competed to pay rising prices for long-term REC procurements. They did this to help cause new renewable capacity instead of buying RECs from long-existing renewable energy projects that are technically permitted by the GHG Protocol but are viewed by SR Inc Member-Clients as less attractive than RECs from renewable projects they helped cause. This increased demand for what SR Inc describes as “Purchaser Caused RECs” has enabled developers to pass on increased supply chain costs to corporate off-takers without decreasing corporate demand.

Whether working with fellow SR Inc Member-Clients in the Net Zero Consortium for Buyers (NZCB) or with independent buyer advisory services, all SR Inc Member-Clients of sufficient scale are interested in the VPPA market as they chart paths to Net Zero Emissions globally. Every quarter since 2019, SR Inc has therefore been pleased to offer the NZCB VPPA Opportunity Index that enables a comparison of potential wind and solar VPPA performance across U.S. hubs using common analytics. The Index reflects both prior actual (backcast) performance and forward carefully modeled pricing. The Opportunity Index is based on proprietary SR Inc analytics and key data sources including those provided by SR Inc partners LevelTen Energy and REsurety.

We call readers’ attention to the fact that the Index is based upon VPPA offers, not executed transactions, that were made over the prior quarter. As such, these VPPA prices do not fully reflect the now substantial monthly price increases in executed transactions driven in part by Russia’s war of aggression in Ukraine, continued supply chain challenges, and tariff-related issues with imported solar modules.

Key findings from our Q2 analysis include:

- Wind VPPA prices across the country were up 19% on average from the previous 12 months, while solar VPPA prices were also up 19%.

- In the past quarter, average realized wind prices in Q2 2022 were up a whopping 121% across hubs from Q2 2021 and solar prices were up 124%.

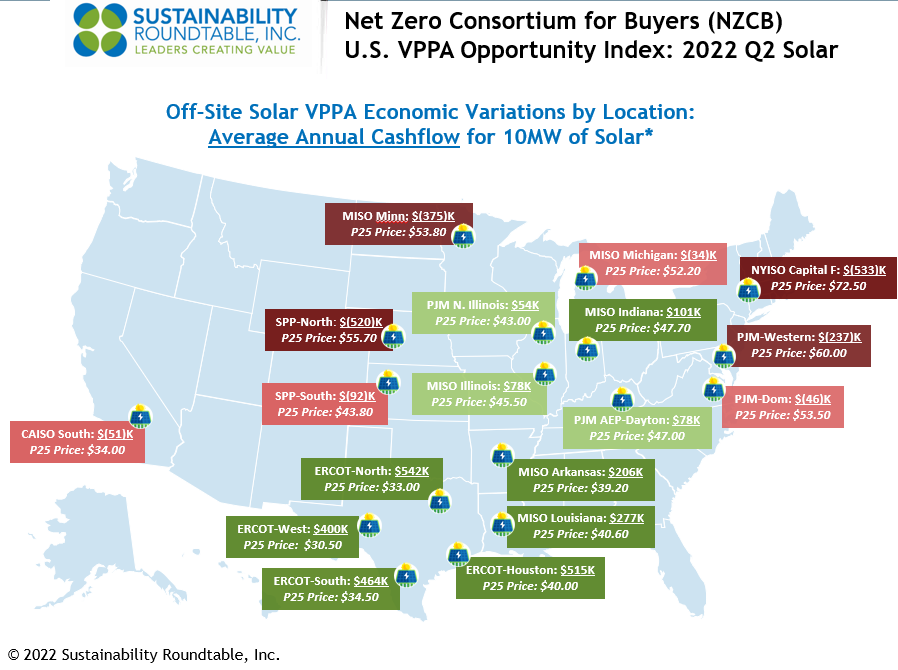

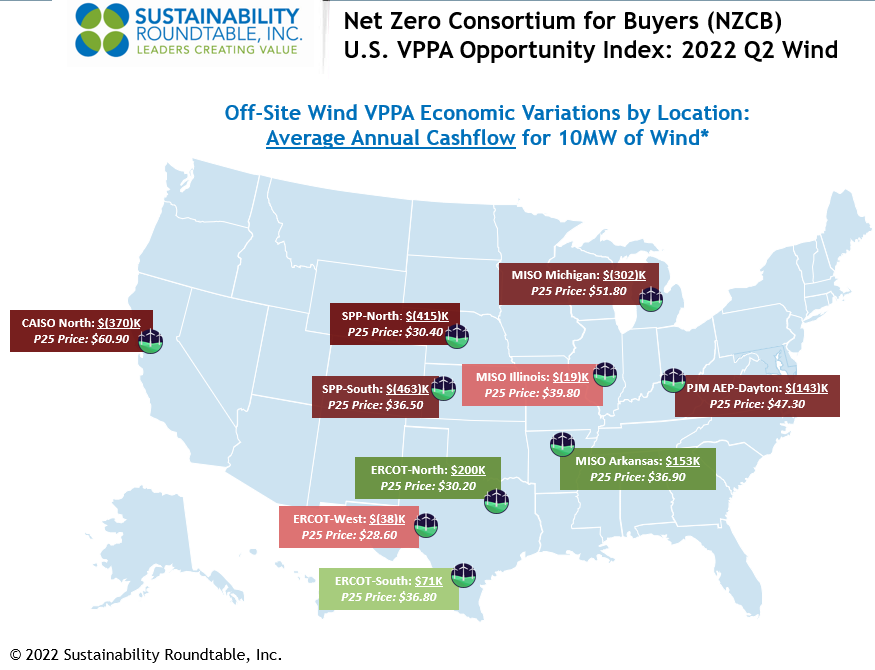

- Our longer-term view Opportunity Index shows that average modeled cashflow through 2037 per 10MW VPPA across hubs improved $30K in Q2 versus Q1 for wind and improved $17K for solar.

- In Q2, wind VPPAs modeled to be less expensive in 60% of all hubs versus buying unbundled RECs (based on a third-party long-term forecast of $4.99/REC), and solar VPPAs modeled to be less expensive in 78% of all hubs.

- The average modeled hub annual cashflow for a 10MW wind VPPA would have been $47K less expensive than buying the equivalent number of unbundled RECs, and the average modeled hub annual cashflow for a 10MW solar VPPA would have been $176K less expensive than buying unbundled RECs.

- Price modeling shows that ERCOT (Texas) solar continued to present the strongest opportunities for positive cash flow in Q2. The average modeled ERCOT annual cashflow for a 10MW solar VPPA was $480K.

- Price modeling shows that ERCOT also continued to present the best opportunities for wind in Q2. The average modeled ERCOT annual cashflow for a 10MW wind VPPA was $78K. The model also showed a cash-positive opportunity for wind in MISO Arkansas.

- Price modeling shows that solar also presented cash positive opportunities in multiple MISO hubs (AR, IL, IN, and LA) and PJM hubs (AEP-Dayton & Northern Illinois) in Q2.

The NZCB VPPA Opportunity Index is an intentionally simplified rendering of complex markets, but NZCB participants find it helpful in beginning to gain an understanding of VPPA market dynamics and financial implications for implementing their renewable energy strategies through VPPAs and aggregated VPPAs. In pursuing any specific VPPA opportunities, NZCB participants require very detailed and custom analytics performed with senior expert assistance before transacting. This assistance requires financial, legal, and market expertise to drive timely procurement strategy development and implementation, transaction structuring, contracting, and negotiation services to create a successful and auditable corporate procurement process in rapidly changing markets.

*Methodology

- To calculate average annual cashflows, SR Inc multiplies 1) the difference of technology-shaped realized market prices (2015-2022) & forecasted technology-shaped electricity futures market prices (2022-2037) versus top quartile VPPA prices in each hub by 2) the typical total annual production for 10MW offtakes for wind and solar, respectively.

- SR Inc uses 36K MWh production per year for 10MW of wind and 26K MWh per year for 10MW of solar to provide “apples to apples” comparisons for both technologies across hubs.

- The top quartile VPPA price assumes a scaled offtake of at least 50MW, but SR Inc uses 10MW because it is typically the minimum individual corporate offtake required within 100+ MW aggregated procurements REPS manages for NZCB participants.

Data Sources

- The NZCB Opportunity Index is developed from proprietary analytics and multiple data providers, which include:

- LevelTen Energy PPA Price Index top quartile VPPA pricing data for Q2 2022 (all proposed projects of 8+ years)

-

- REsurety REmap actual average, technology-shaped realized market prices for 2015-2022 and technology-shaped future market price forecasts for 2022-2037 (as of June 30, 2022) based on multiple electricity futures markets.

If you have any additional questions, or would like to learn more about the NZCB, contact info@sustainround.com.