In this Q+A, SR Inc CEO Jim Boyle speaks with Lamar Johnson of ESG Dive about how SR Inc's Sustainable Business & Enterprise Roundtable Member-Clients are reacting to the Science Based Targets initiative's proposed Corporate Net Zero Standard v2.

The wide-ranging conversation addressed questions including:

- What SR Inc is hearing from Member-Clients about the SBTi draft

- What the world's leading sustainability teams are most encouraged -- and concerned -- by

- Why SR Inc believes prioritizing purchaser causation of new renewable energy projects is more important than focusing on matching renewable energy credits by location and time

- How SR Inc's SBER membership is responding to changes in ESG sentiment, United States climate policy, and the European Union climate risk disclosure landscape

- What CEO Jim Boyle sees as the most positive changes seen in SBTi's draft

- How SBER members think the tariff situation may impact their sustainability programs

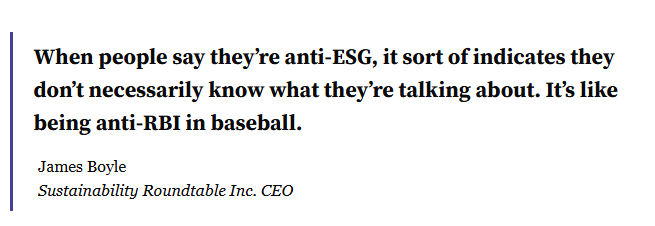

Among the discussion's many insights, we found one quote particularly evocative.

Why is ESG like RBIs? Discover the rationale behind the baseball analogy (and much more) in the full article on ESG Dive.